Featured Posts

Last week, people saw the 7% spike in the S&P 500 and called it a relief rally. Markets breathed. Volatility cooled off for a moment. But what actually happened wasn’t just a response to Trump’s sudden 90-day tariff pause. It was a pressure release after days

Let’s talk markets. Specifically, let’s talk about what just went down (literally) in the Nasdaq this week. If you’ve been paying attention—or maybe even if you haven’t—it’s gotten pretty ugly pretty fast. I even tweeted something about it: Markets take the stairs up

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

The S&P 500 surged 1.72% this week, marking its best opening week under any president since 1985.

A $500 billion AI initiative and a key crypto executive order also fueled the tech and riskier asset sectors.

Let’s break it down.

Market’s Winning Week

Here’s how the major U.S. indexes performed:

- S&P 500: +1.72%

- Dow Jones: +2.04%

- Nasdaq 100: +0.98%

- Russell 2000: +0.93%

Tech stocks also stole the spotlight. Oracle jumped 14%, Nvidia rose 3.6%, and Arm gained 8.9%. Much of this was driven by the newly announced Stargate AI project, a $500 billion initiative aimed at boosting AI infrastructure.

Why Everyone Feels Bullish

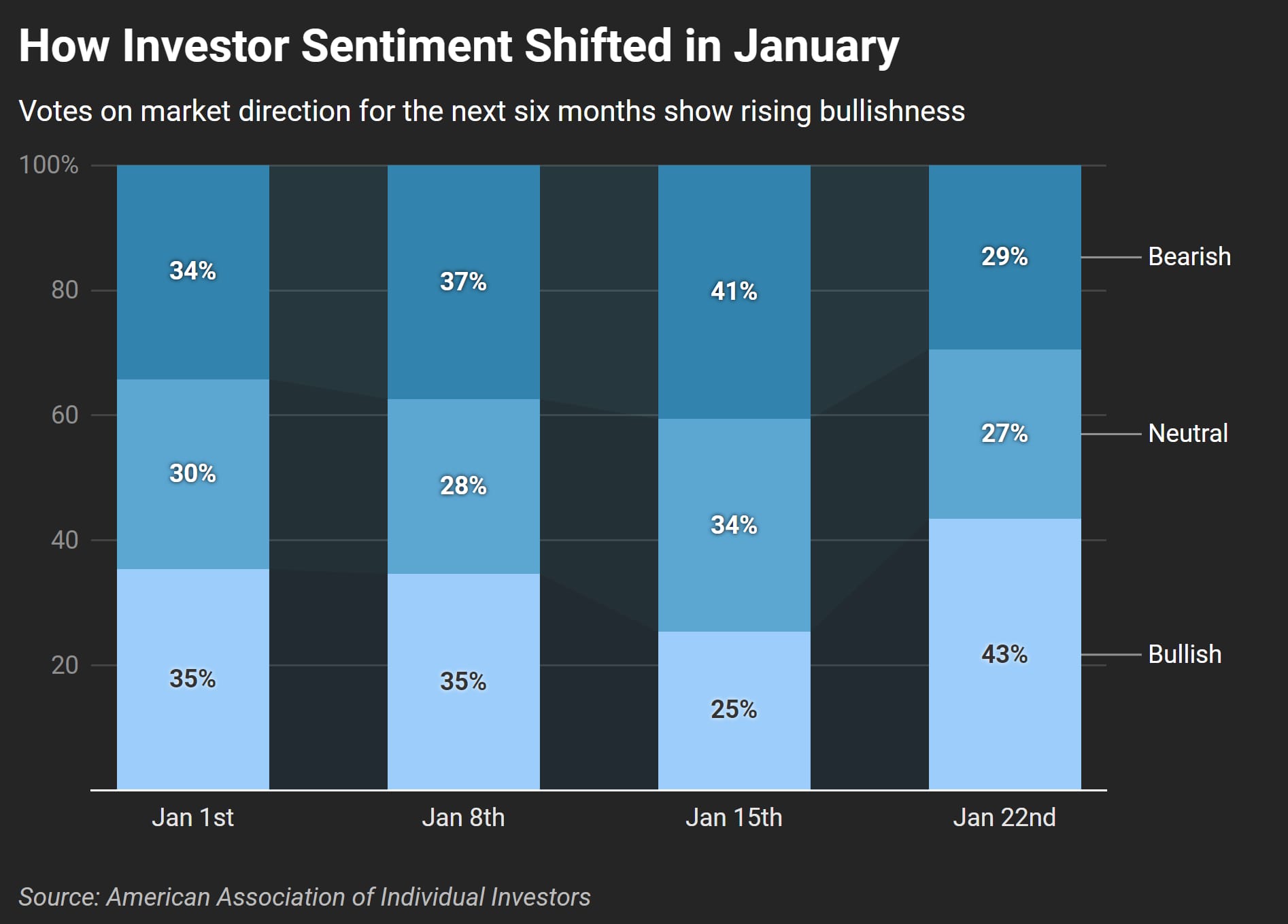

Investor sentiment shifted sharply this week, with bullish sentiment jumping to 43.4% (from 25.4% last week) while bearish sentiment fell to 29.4%.

It’s not just about sentiment, though. Trump’s executive order on digital assets sent Bitcoin soaring to $105,000.

Yields are Moving

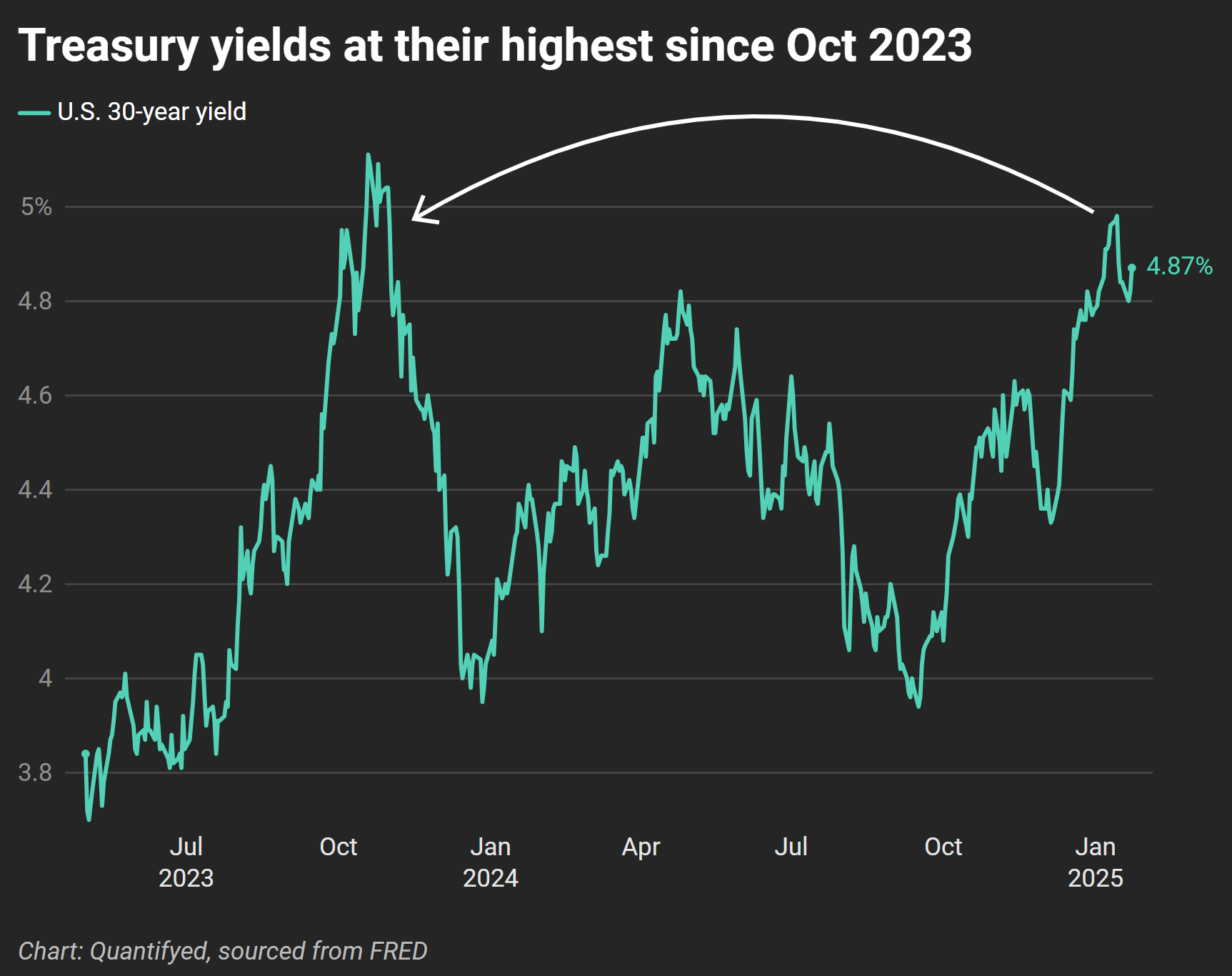

Despite optimism growing, rising Treasury yields are getting intimidating. The yield on the 30-year Treasury hit 4.87% this week, its highest level since October 2023:

Higher yields can increase borrowing costs for businesses and consumers, creating headwinds for market performance. Yet, the broader economy remains strong, with unemployment at a record low of 4.1%.

What You Need to Know:

- Indexes Climbed: S&P 500 is up 1.7%, Dow Jones rose 2%, and Nasdaq is up 0.9%

- Tech Jumped: Oracle soared 14% this week, helped by AI investments

- Yields Rose: The 30-year Treasury yield climbed to 4.87%, the highest since Oct 2023