Featured Posts

Last week, people saw the 7% spike in the S&P 500 and called it a relief rally. Markets breathed. Volatility cooled off for a moment. But what actually happened wasn’t just a response to Trump’s sudden 90-day tariff pause. It was a pressure release after days

Let’s talk markets. Specifically, let’s talk about what just went down (literally) in the Nasdaq this week. If you’ve been paying attention—or maybe even if you haven’t—it’s gotten pretty ugly pretty fast. I even tweeted something about it: Markets take the stairs up

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

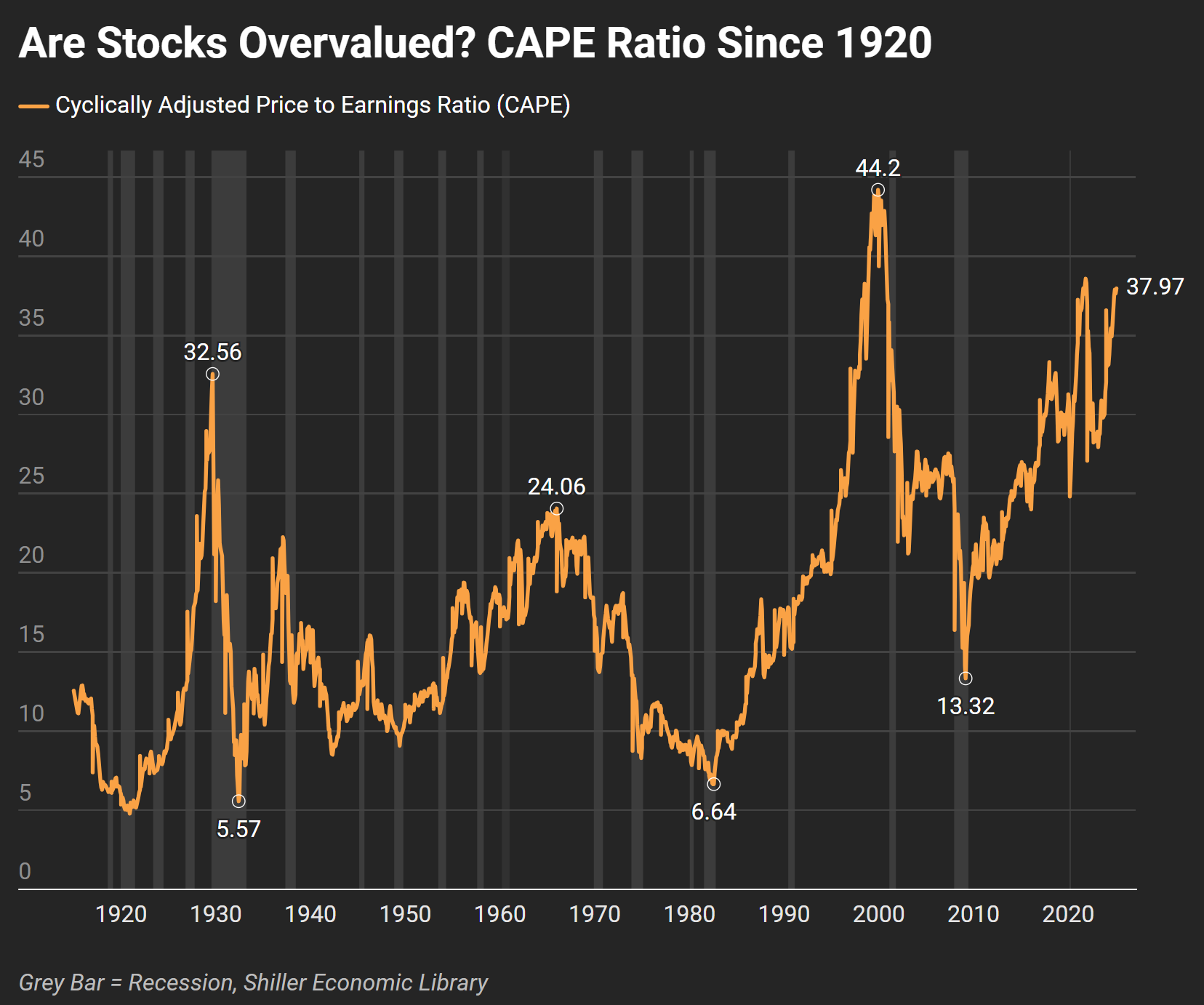

Every time the market rallies to new highs, people start asking the same question: Are we in a bubble?

And every time, the answer is basically the same: maybe, but we won’t know until it pops. That’s how bubbles work. They never feel obvious in real-time.

The 1999 Dot-Com bubble? It was justified by “the new economy.”

The 2008 housing bubble? It was considered a once-in-a-lifetime opportunity to buy real estate with no money down.

Every cycle has its own version of “this time is different.”

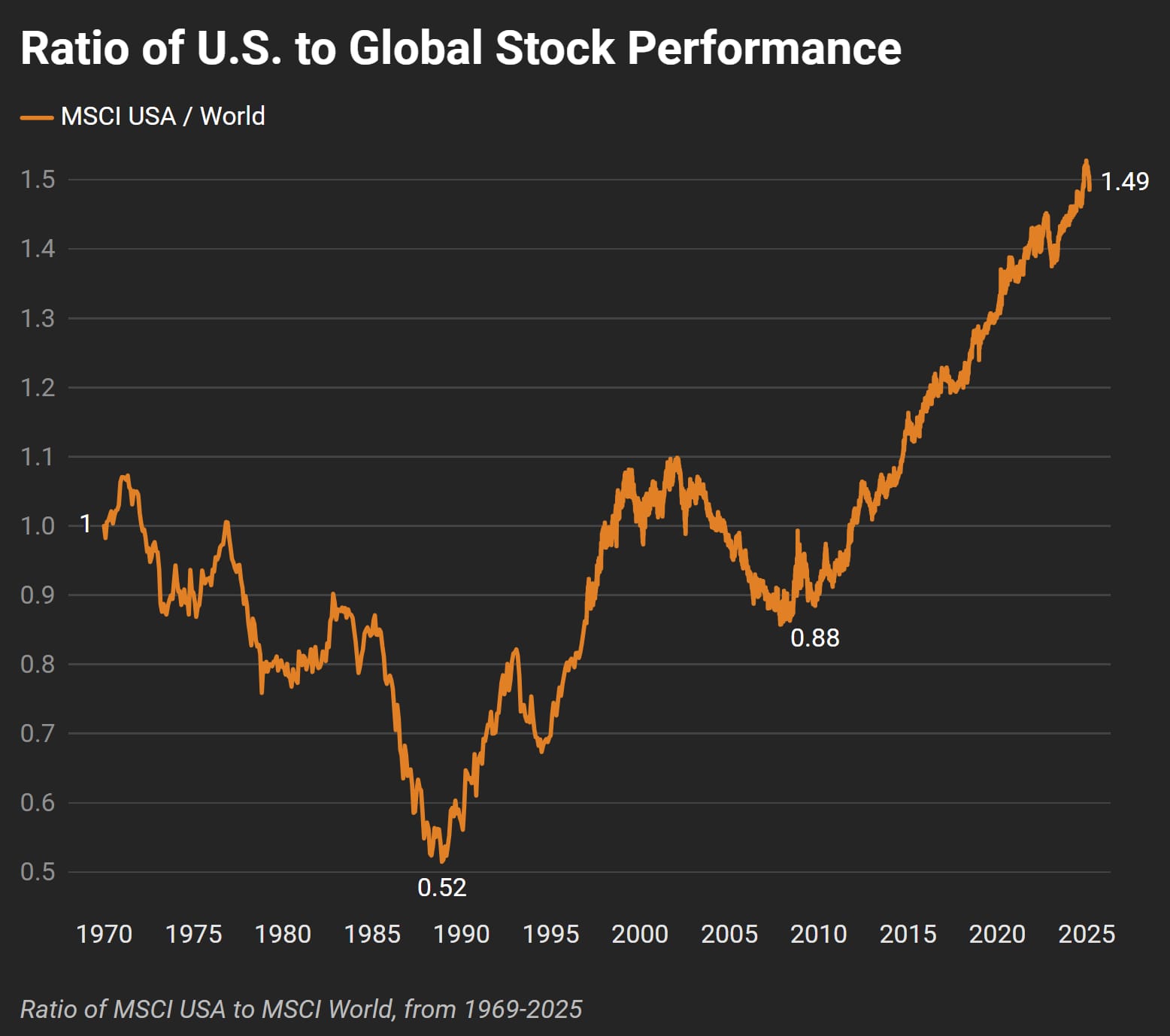

Can US Stocks Keep Dominating?

Let’s start with an undeniable fact: US stocks have dominated the market for the last 15 years.

If you compare the performance of the MSCI USA index to the MSCI World index (which includes all developed markets), you see a trend:

Back in 2010, when the market was still recovering from the financial crisis, the ratio of US to global stocks performance sat at 0.88—basically, US stocks were underperforming the rest of the world.

Fast forward to today, and that number has exploded to 1.49, meaning US stocks have significantly outpaced the rest of the world’s markets.

The big question is: why?

Is it because US companies are fundamentally better than the rest of the world? Or is this just the result of easy monetary policy, trillions in stimulus, and US tech stocks? History suggests that markets tend to cycle. Leadership rotates and outperformance reverts.

My assumption is that this can’t go on forever. The ratio itself has a natural cap—US stocks can’t make up 100% of global market cap. But the real concern isn’t just that US stocks have gone up—it’s that investors are treating US stocks as the only opportunity available.

US Stocks Are Historically Expensive

Valuations are used as a red flag for market bubbles. But lately, valuation metrics feel like background noise. Everyone acknowledges them, but no one seems to care.

The Cyclically Adjusted Price-to-Earnings (CAPE) ratio, is a version of the P/E ratio that smooths out earnings over a 10-year period to account for economic cycles.

Right now, it sits at 37.97, a level we’ve only seen twice before: right before the 1929 crash and at the peak of the Dot-Com bubble.

For reference, the historical average is between 15-16

It feels like the market's accepted a different narrative: maybe the old rules don’t apply anymore.

How Might a Market Crash Look?

Let’s say we are in a bubble. What would cause it to pop?

It probably wouldn’t be valuations alone. Markets don’t collapse just because they’re expensive–they collapse when something shifts sentiment.

In 2000, it was the realization that most Dot-Com companies had no profits. In 2008, it was the realization that mortgage-backed securities were toxic.

So what’s the potential cause today? A Fed-induced liquidity crunch? A slowdown in corporate earnings? A loss of faith in AI return on investment?

Are We in a Bubble? Maybe.

If you’re looking at valuations, the case for a bubble is strong. Stocks are trading near their most expensive levels in history and US markets have gone nearly 15 years without any real mean reversion compared to the rest of the world.

But if you ask today’s investors, they’ll tell you that valuations are outdated, that the market has fundamentally changed, that things like passive investing, technology, and globalization have altered the old rules.

Do you think this time is different?