Featured Posts

Last week, people saw the 7% spike in the S&P 500 and called it a relief rally. Markets breathed. Volatility cooled off for a moment. But what actually happened wasn’t just a response to Trump’s sudden 90-day tariff pause. It was a pressure release after days

Let’s talk markets. Specifically, let’s talk about what just went down (literally) in the Nasdaq this week. If you’ve been paying attention—or maybe even if you haven’t—it’s gotten pretty ugly pretty fast. I even tweeted something about it: Markets take the stairs up

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

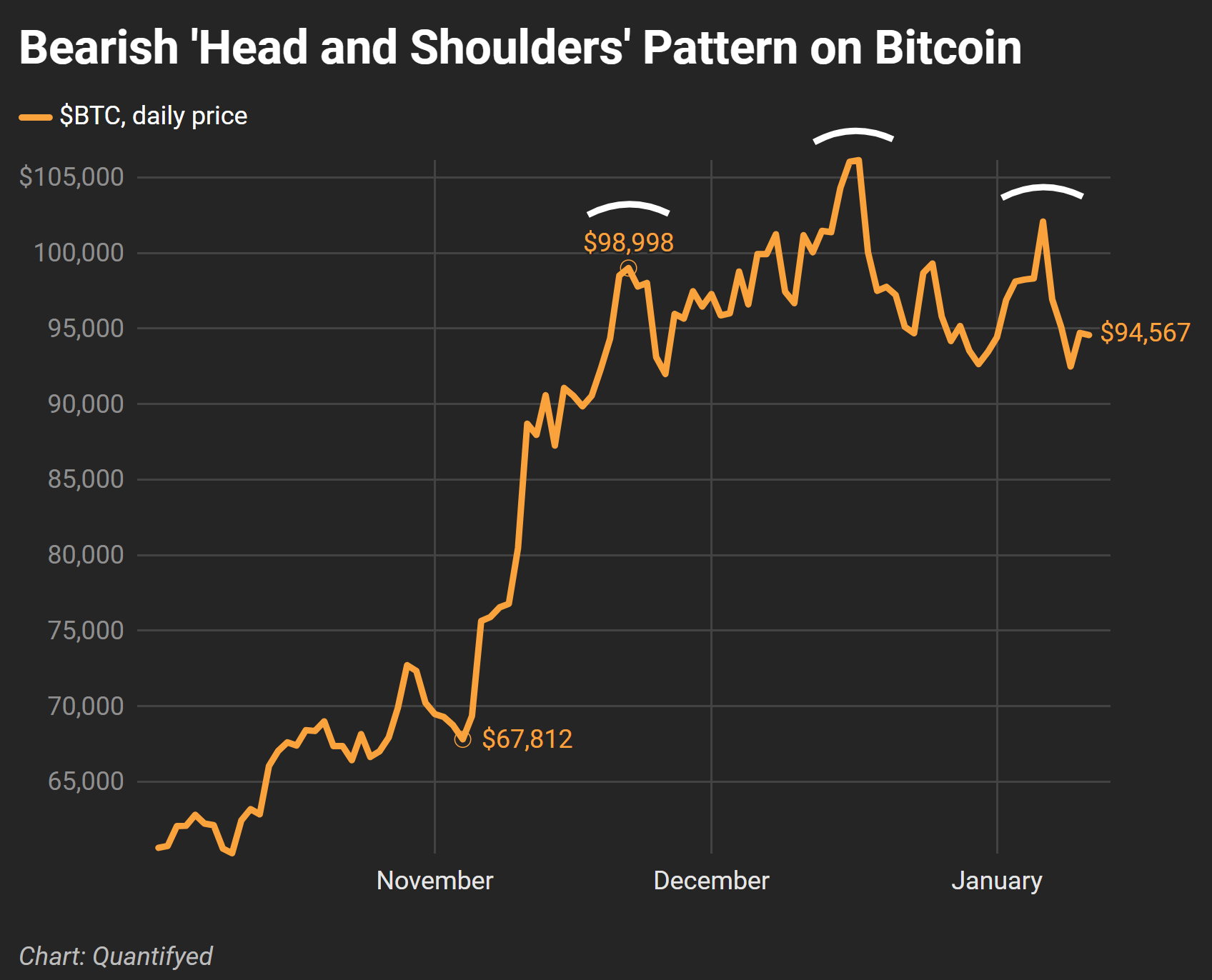

Bitcoin is sinking. It’s down 4.2% today, falling below $91,000—the lowest in two months. Ethereum is getting hit even harder, dropping 9.3%. Rising Treasury yields are making investors dump riskier bets like crypto.

Let’s break it down.

Crypto Drops, Bond Yields Rise

Bitcoin breaking below $91,600 was a big deal. That level was seen as strong support (per Bloomberg) and now analysts think it could drop further to $88,000.

Why’s this happening? Friday’s jobs report added 256,000 new jobs (vs 165k expected), implying the Fed won’t cut rates anytime soon. Rising yields make riskier assets like crypto less attractive, and Bitcoin is taking the brunt of it.

Market Reactions to Treasury Yields

Yields are climbing fast. The 10-year Treasury yield hit 4.78%, its highest in 14 months, and the 30-year yield is inching toward the key 5% level.

Higher yields mean higher borrowing costs, which put pressure on stocks and crypto. Traders have given up on rate cuts for now, with some even predicting no cuts at all this year.

The fallout isn’t just in crypto. Here’s what else is moving:

Stocks this morning:

- S&P 500: -0.76%

- Nasdaq 100: -1.47%

- Dow Jones: +0.15%

Oil and the dollar:

- WTI crude rose 2% to $78.09 as new sanctions on Russia added to supply worries.

- The dollar is gaining too, hitting a two-year high.

Cryptocurrencies:

- Bitcoin: -4.2% to $90,506

- Ether: -9.3% to $2,964