Featured Posts

Last week, people saw the 7% spike in the S&P 500 and called it a relief rally. Markets breathed. Volatility cooled off for a moment. But what actually happened wasn’t just a response to Trump’s sudden 90-day tariff pause. It was a pressure release after days

Let’s talk markets. Specifically, let’s talk about what just went down (literally) in the Nasdaq this week. If you’ve been paying attention—or maybe even if you haven’t—it’s gotten pretty ugly pretty fast. I even tweeted something about it: Markets take the stairs up

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

Ever thought about how dependent we’ve become on technology? Well, the recent cyberattack on CDK Global, a major software provider for car dealerships, gave us a harsh reminder.

This attack stopped operations at 15,000 dealerships— there's about 70,000 of those in the US.

What Happened? The cyberattack struck CDK Global early morning on June 19, right on Juneteenth, a busy holiday for car dealers. Initially, CDK managed to restore some services by midday, but a second attack forced another shutdown.

What is CDK's Role in the Automotive Industry? CDK’s dealer management system (DMS) is pretty much the backbone of car dealership operations. It handles everything from sales leads and trade-ins to auto loans and vehicle registration.

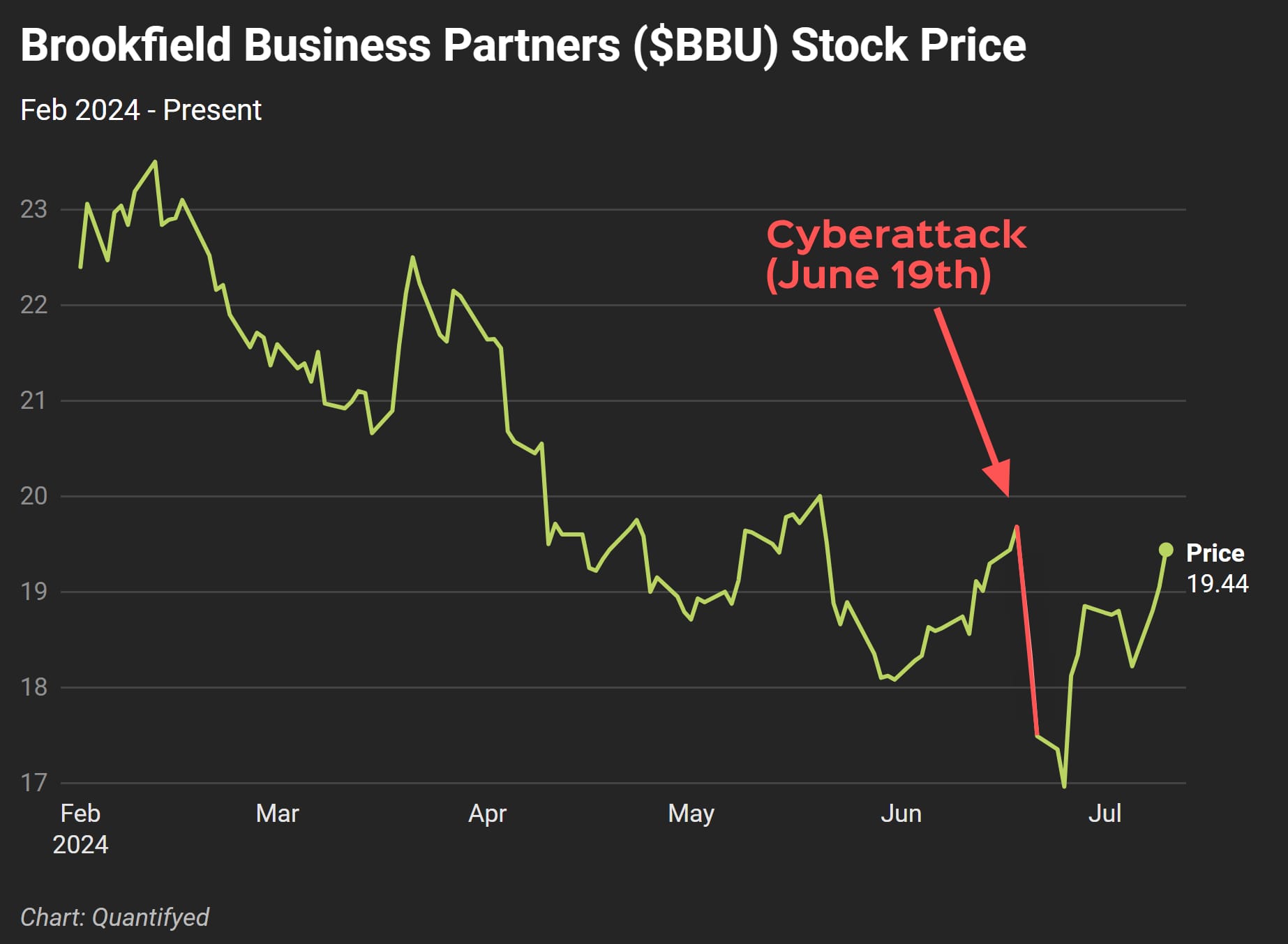

With CDK down, dealerships had to revert to pen and paper. Brookfield Business Partners, which acquired CDK for $8.7 billion last year, saw its stock take a nosedive 👇

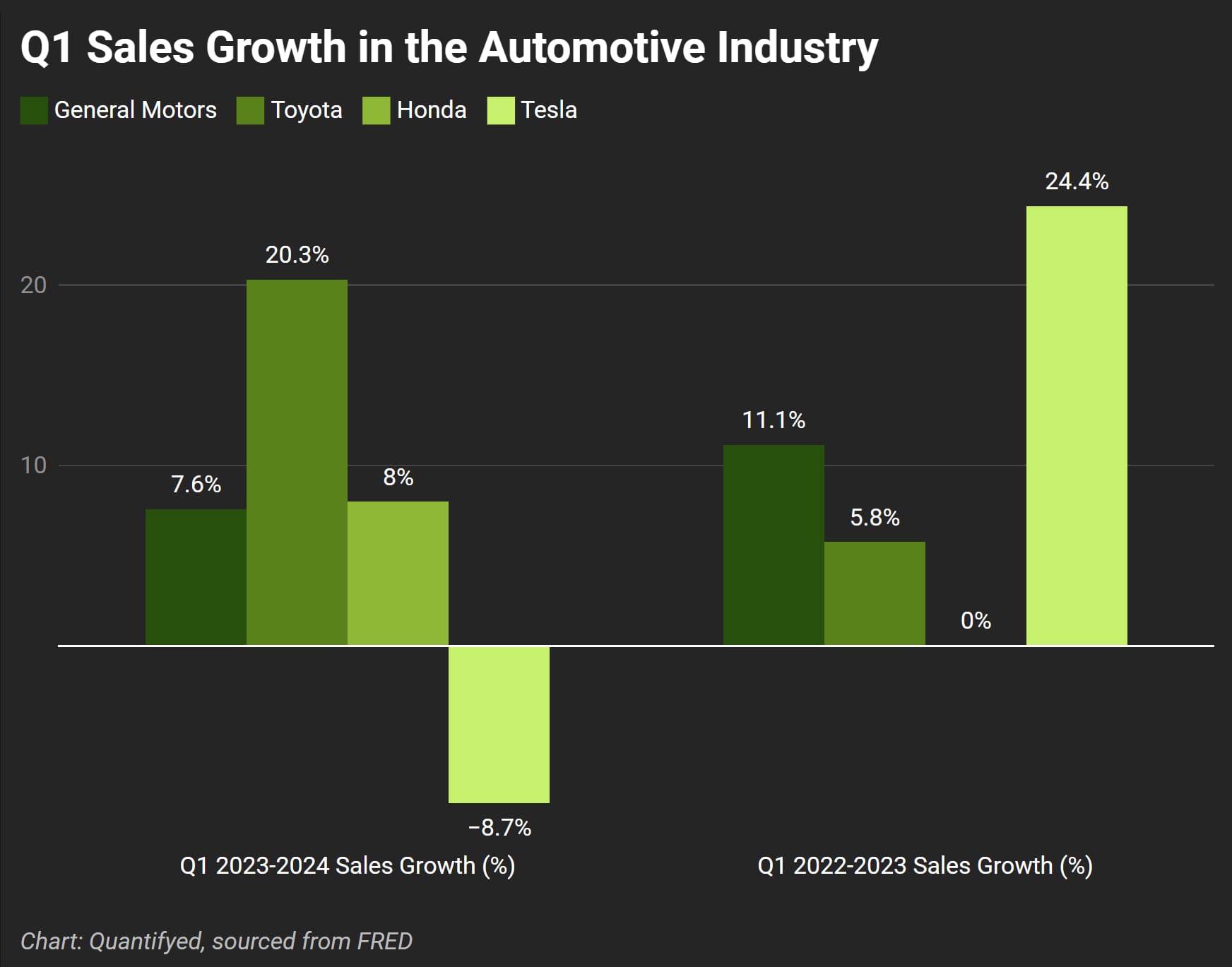

Despite the cyberattack, the sales growth numbers of many major car companies were mixed:

In Q1 2023-2024, General Motors saw a modest sales growth of 7.6%, slightly down from 11% the previous year. Toyota's sales growth jumped a lot to 20% from 5.8% in Q1 2022-2023. Honda had a slow, but modest increase in sale, reporting 8% in Q1 2023-2024 compared to 0% previously. Tesla faced the steepest decline, with sales plummeting by -8.7% after a strong 24.4% growth in the previous year.

Since the automotive industry is already grappling with high vehicle prices and rising interest rates, a cyberattack is the last thing a dealership wants.

Where do you see the automotive industry headed? What do you think poses the biggest risk to car dealerships other than cyberattacks?