Featured Posts

Last week, people saw the 7% spike in the S&P 500 and called it a relief rally. Markets breathed. Volatility cooled off for a moment. But what actually happened wasn’t just a response to Trump’s sudden 90-day tariff pause. It was a pressure release after days

Let’s talk markets. Specifically, let’s talk about what just went down (literally) in the Nasdaq this week. If you’ve been paying attention—or maybe even if you haven’t—it’s gotten pretty ugly pretty fast. I even tweeted something about it: Markets take the stairs up

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

It's no secret that our job market looks far different than it did a few years ago. Since the Federal Reserve first raised interest rates in March 2022, the cost of borrowing has risen dramatically, slowing our economy significantly.

Today, we’re seeing signs of a weaker job market, and these three charts will explain how this moment looks—and what it means for you:

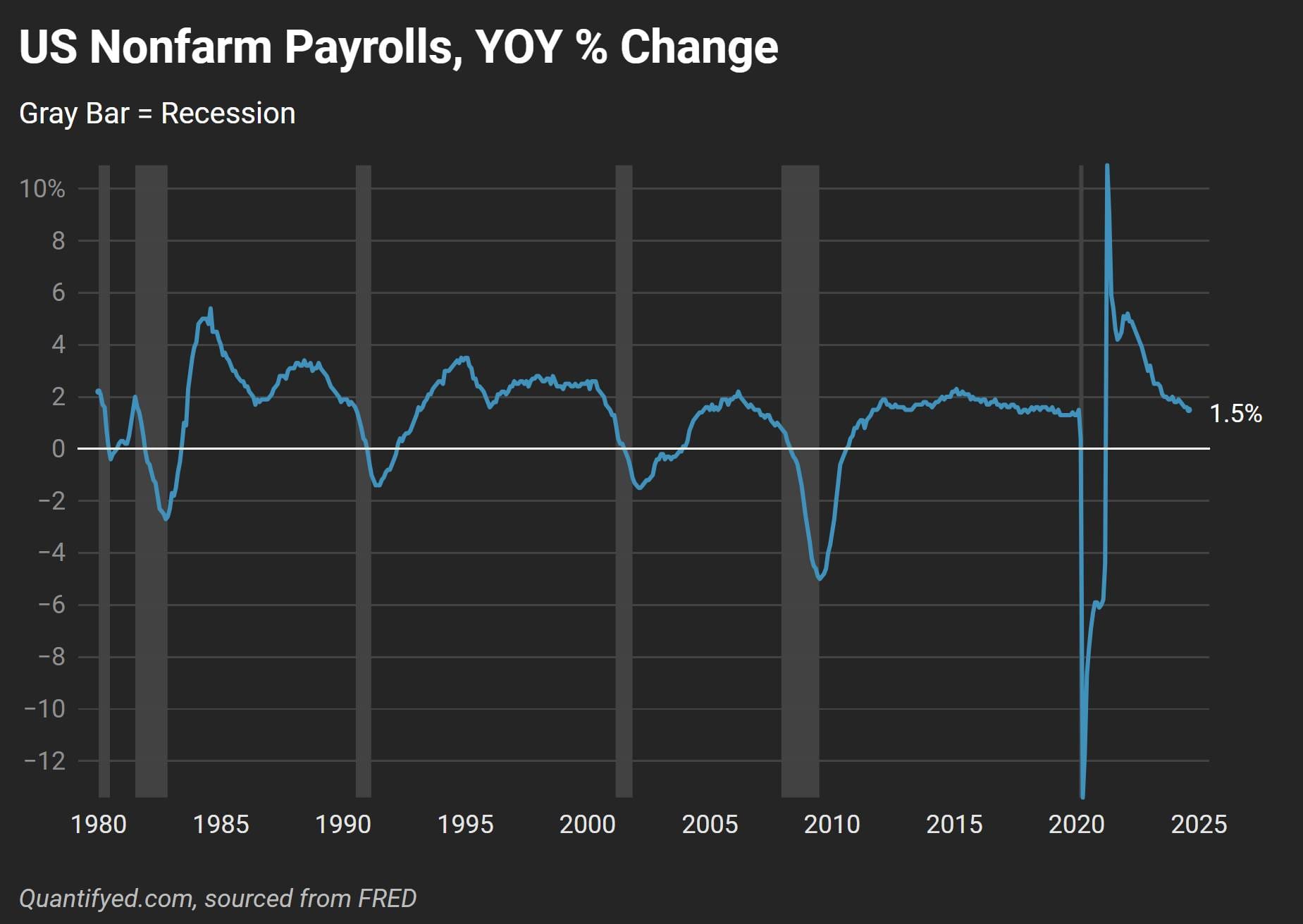

Payrolls are a key indicator of the health of the job market. They represent the total number of paid workers in the US each month, giving a snapshot of whether businesses are hiring or laying off employees. A healthy economy typically sees steady payroll growth, but this time it's different.

Just yesterday, US nonfarm payrolls missed estimates, coming in at 142k vs 164k expected. That also means over the past year, payrolls have only grown by 1.5%, well below our historical average of 2%.

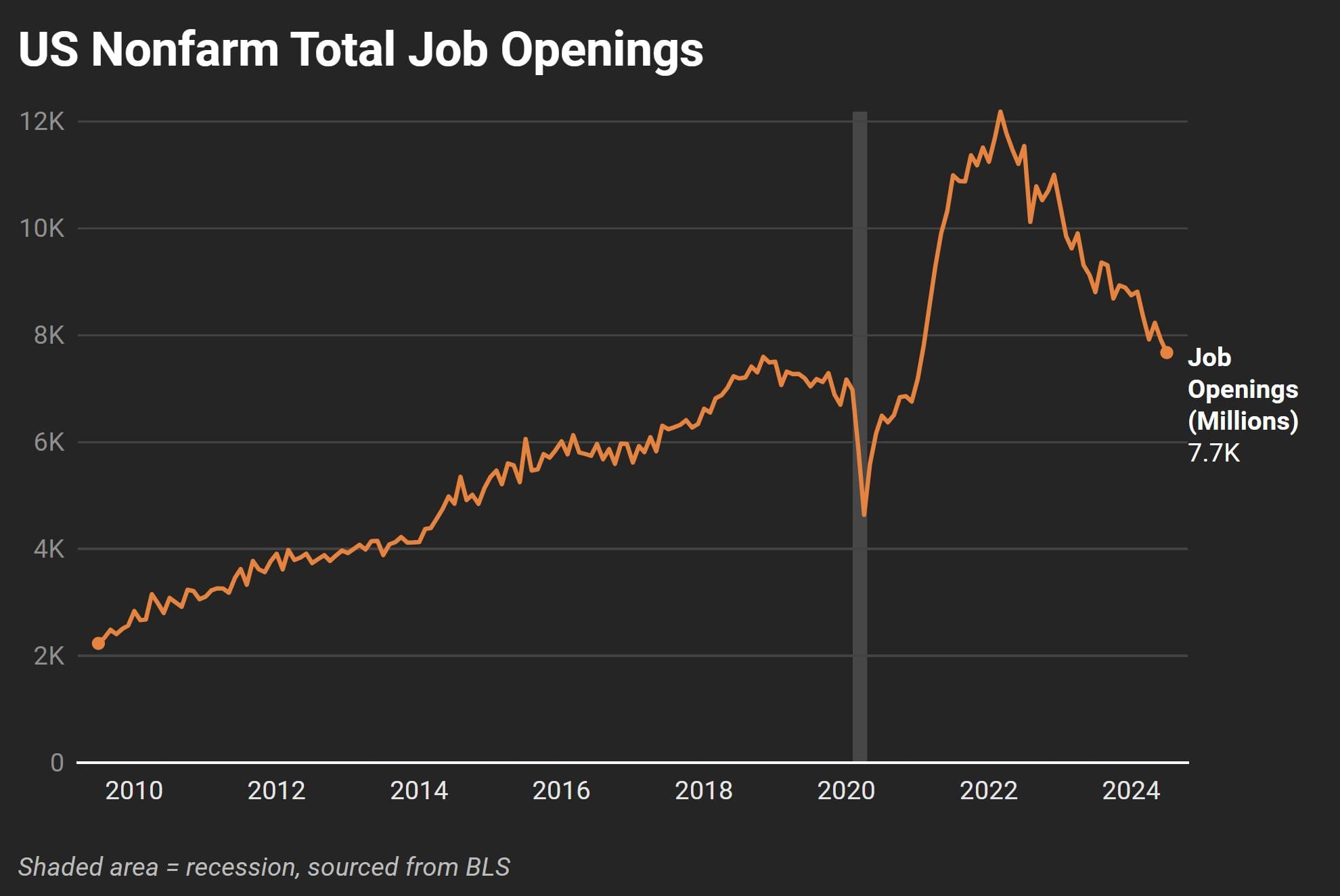

Another indicator of economy is job openings. When businesses feel optimistic, they hire more, and job openings increase. When they’re feeling a pinch, hiring slows (or even freezes) altogether. Right now, openings are on a downward slide.

According to the latest data, US nonfarm job openings dropped to 7.7 million—below the 8.1 million expected. This is a clear sign that businesses are tightening their belts as the economic outlook becomes increasingly uncertain. The steady decline in job openings, which has been happening since early 2021, shows the reality of a cooling post-pandemic economy

This data also points to a big problem for anyone currently looking for work: fewer opportunities are available, and competition is fiercer than ever.

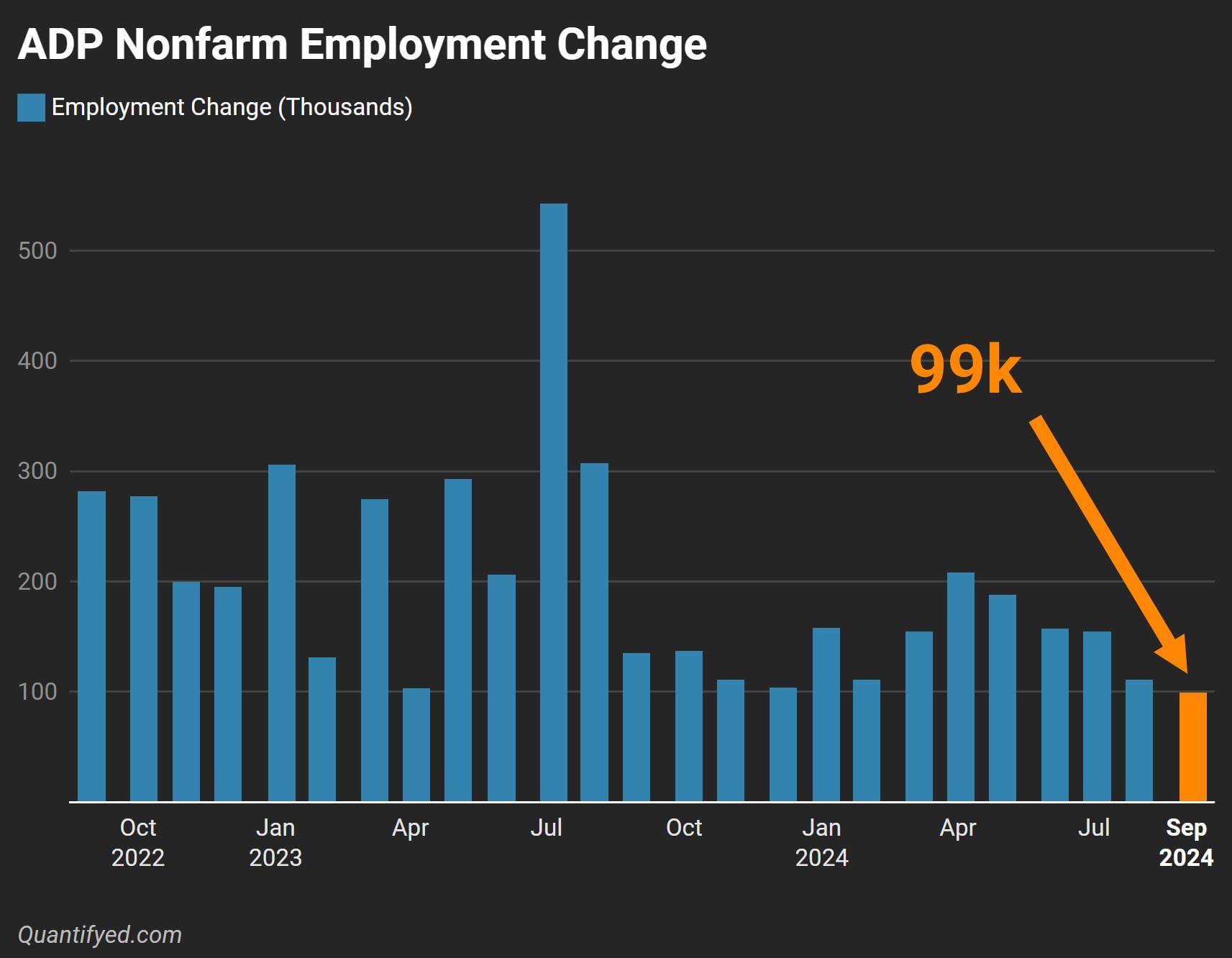

The final nail in the coffin? The ADP Nonfarm Private Employment report, which gives us a monthly estimate of how many private-sector jobs are added or lost. In September, we saw a massive miss: only 99k jobs were added, far below the previous months' numbers.

Job growth has been erratic at best over the past year, but September numbers are particularly concerning:

With such sluggish growth, the Fed’s aggressive rate hikes are finally making themselves felt in the labor market.

Here’s the deal: it’s not looking good. With payroll growth slowing, job openings dropping, and employment change numbers way off the mark, it’s clear that the job market is weakening. If you’re job hunting, the process could take longer, and more competiton could roll in.

For businesses, this means tightening budgets and being more cautious with hiring decisions. And if we do slide into a recession, the job market is only going to get worse. What do you think?