Featured Posts

Last week, people saw the 7% spike in the S&P 500 and called it a relief rally. Markets breathed. Volatility cooled off for a moment. But what actually happened wasn’t just a response to Trump’s sudden 90-day tariff pause. It was a pressure release after days

Let’s talk markets. Specifically, let’s talk about what just went down (literally) in the Nasdaq this week. If you’ve been paying attention—or maybe even if you haven’t—it’s gotten pretty ugly pretty fast. I even tweeted something about it: Markets take the stairs up

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

Bitcoin’s price has dropped by more than 70% in a single quarter, but new ETFs are helping investors reduce the risk of those wild swings. Here’s how.

For everyone, this volatility makes it hard to justify adding cryptocurrenices to their portfolios. Just look at Bitcoin's price over this decade👇

Bitcoin fell over 75% from it's 2022 high ($67.5k) to just $16.5k. It's not suprising investors steer clear of it.

How Crypto ETFs Reduce Risk

New crypto ETFs coming out are attempting to make crypto investing less risky. Here’s how:

- Buffer ETFs

These ETFs protect against losses up to a certain percentage (e.g,. 10% or 30%) but cap your potential gains. If Bitcoin drops, you’re covered. If it rises, your gains are limited. - Covered Call ETFs

These ETFs provide steady income by trading away some of Bitcoin’s potential upside. This means less risk, but also fewer chances for big profits if Bitcoin’s price spikes.

These strategies help smooth out Bitcoin’s wild swings, making it a more comfortable investment for those worried about major losses.

Why Crypto ETFs Are Gaining Popularity

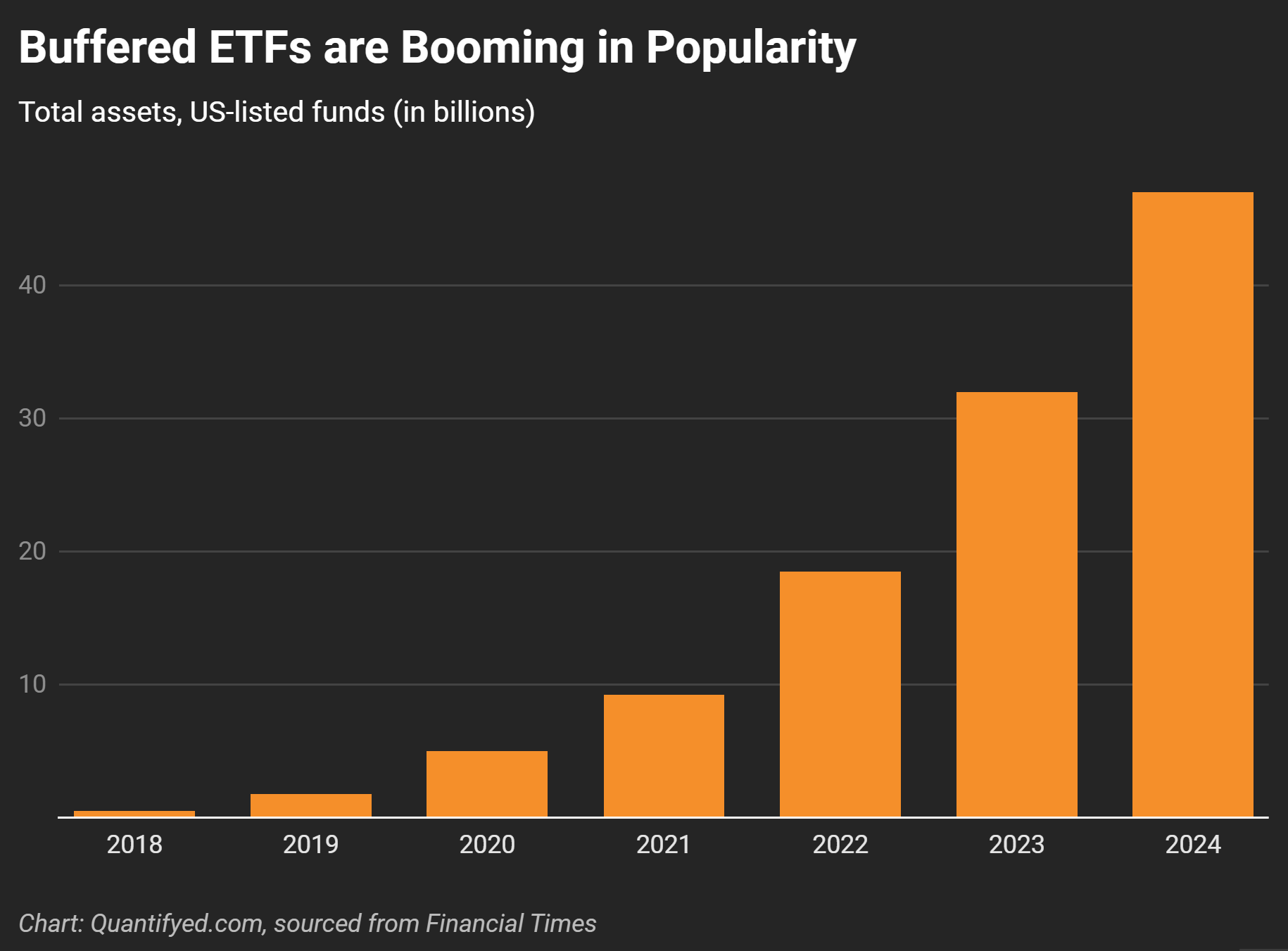

The demand for risk-managed ETFs is skyrocketing. In traditional markets, assets in buffer ETFs grew from near zero in 2019 to $47 billion in 2024, according to Financial Times.

The demand is clear—investors are looking for safer ways to invest, and crypto ETFs are catching on to this trend.

There's One Downside to these ETFs

Though promising, regulatory approval is still pending, and the size of these funds is limited by options trading rules. If you’re not comfortable with Bitcoin’s risks, these ETFs may not be the solution.

Key Takeaways

- Bitcoin’s price can drop over 70% in a quarter, making it highly volatile.

- Buffer ETFs can protect up to 30% of losses while capping gains.

- Buffered ETFs grew from $0 in 2018 to $47 billion in 2024, showing huge demand.