Featured Posts

Last week, people saw the 7% spike in the S&P 500 and called it a relief rally. Markets breathed. Volatility cooled off for a moment. But what actually happened wasn’t just a response to Trump’s sudden 90-day tariff pause. It was a pressure release after days

Let’s talk markets. Specifically, let’s talk about what just went down (literally) in the Nasdaq this week. If you’ve been paying attention—or maybe even if you haven’t—it’s gotten pretty ugly pretty fast. I even tweeted something about it: Markets take the stairs up

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

A few weeks back, the presidential debate was a disaster for Biden. Today, an assassination attempt was made on Trump during a rally in Pennsylvania.

This event is sending shockwaves through the world.

Here’s how Trump's policies will impact our economy if he wins; the good and the bad ⬇️

From 2016 to 2024, The Tax Cuts and Jobs Act (TCJA) has continued to reduce corporate tax rates from 35% to 21%. These cuts, set to expire in 2025, would be extended under Trump, confirmed by CNBC.

This policy will keep lower tax rates and boost corporate profits. On the other hand, Biden proposes letting these cuts expire for high earners and raising corporate tax rates.

For example, a company earning $10 billion with a 21% tax rate pays $2.1 billion in taxes. If tax cuts end and the rate rises to 35%, it would pay $3.5 billion, eating more out of its free cash flow and valuation.

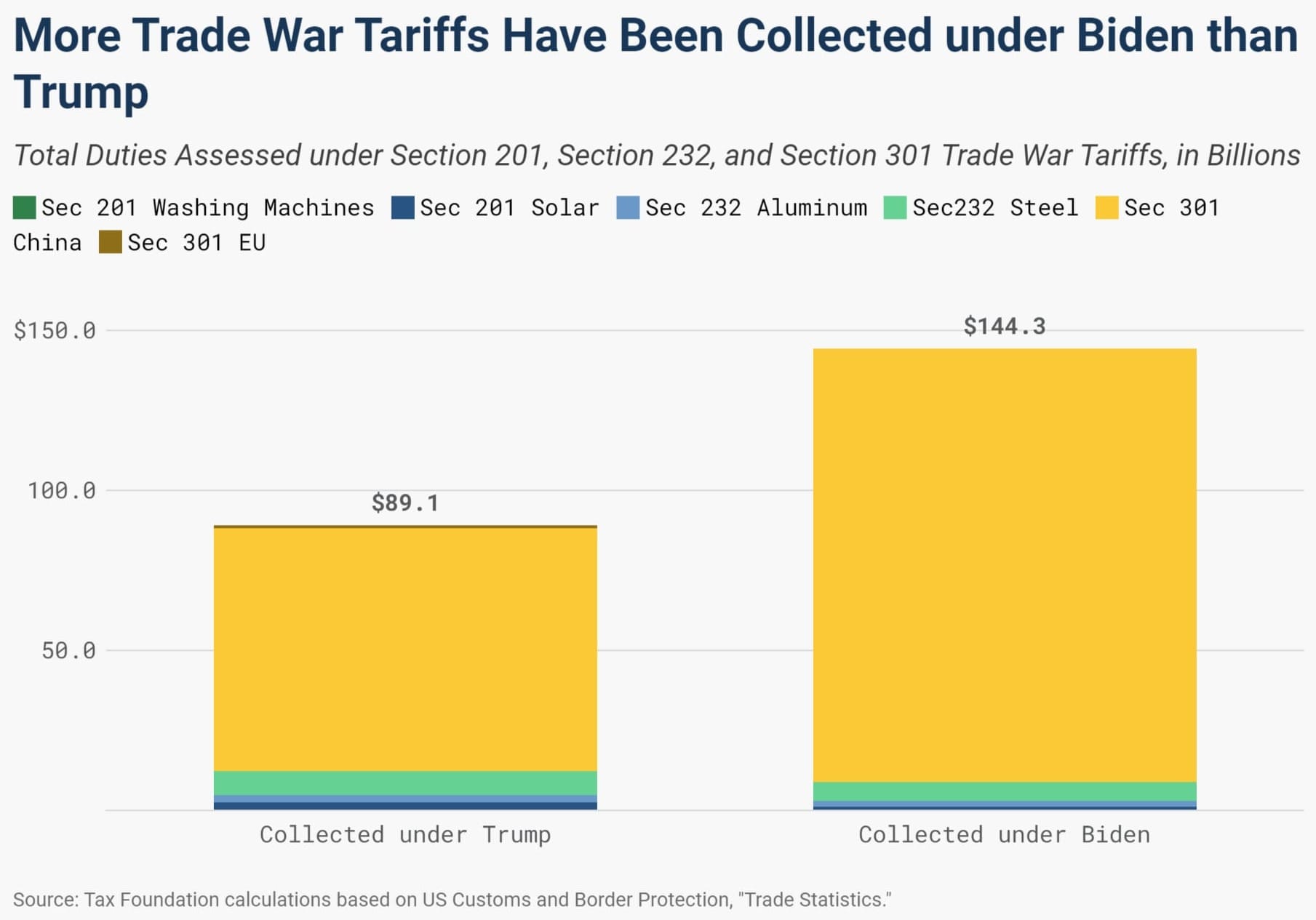

Tariffs: Both Biden and Trump love tariffs, especially on Chinese goods, which protect domestic industries but raise costs for businesses to manufacture things in-house.

These tariffs can be a nightmare for sectors like manufacturing and retail due to higher import costs, but are a dream come true for companies that already make their product in the US.

To dodge the impacts from tariffs, invest in companies with less reliance on international goods and consider ETFs that focus on domestic markets and industries.

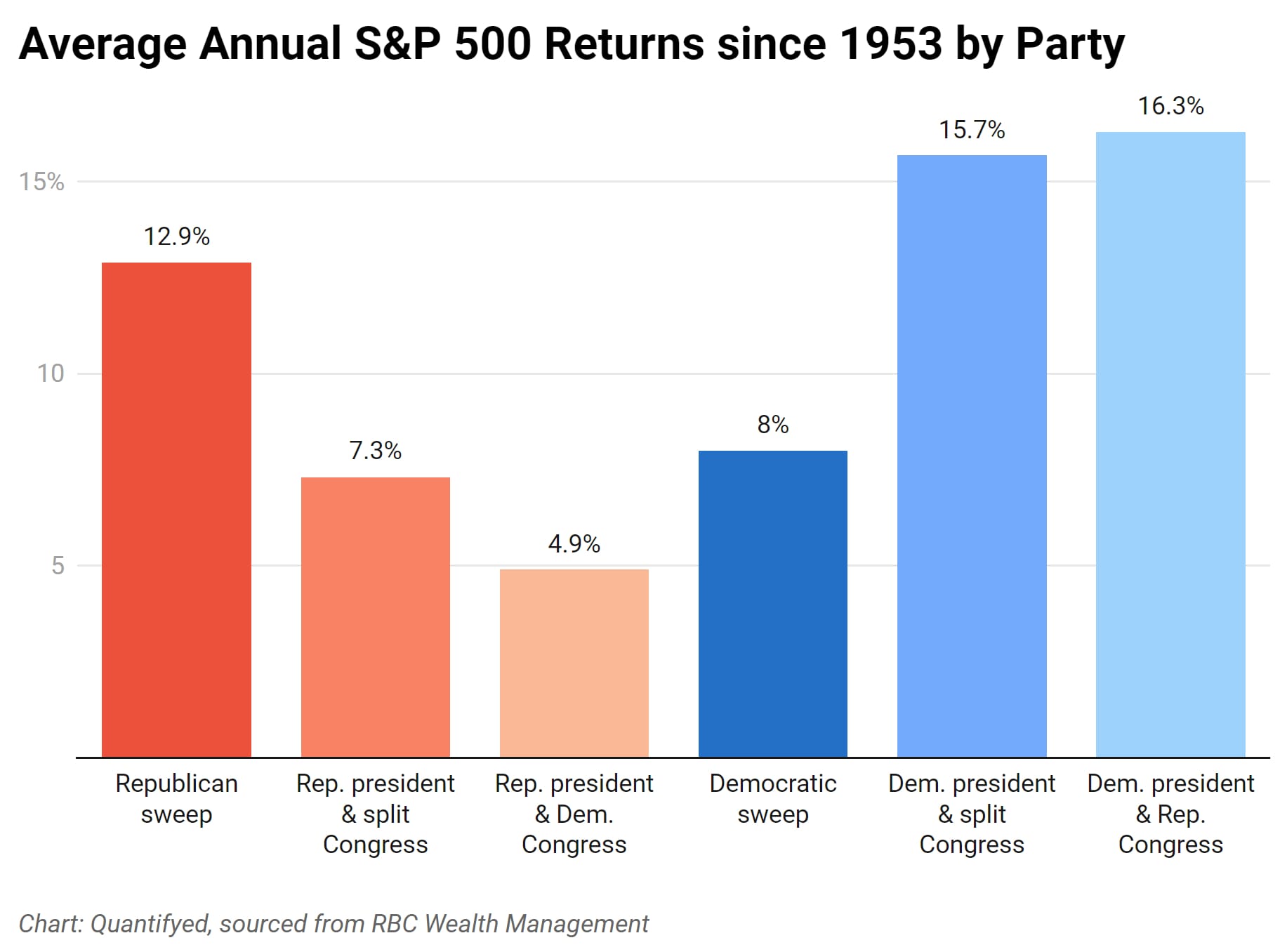

Market Reactions to Political Uncertainty: Historically, the stock market performs best under a divided government, lowering the chance of disruptive policy changes.

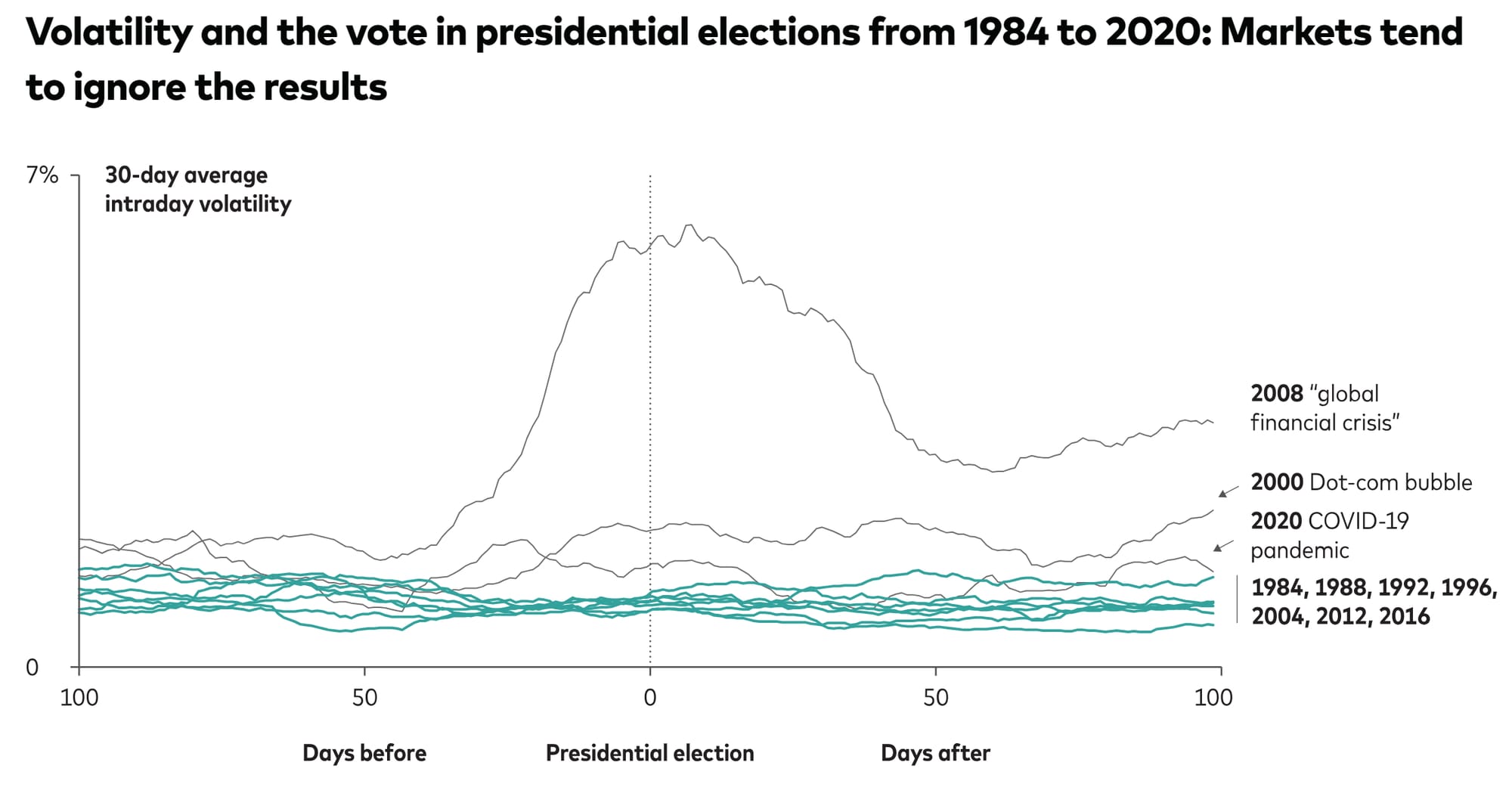

Political uncertainty usually leads to market volatility, so diversification is your best friend here.

So, election season could shake up tax policies, tariffs, and uncertainty in markets.

Think of the stock market as a reality show– full of drama and unexpected twists. By staying on top of these changes, you can handle whatever comes your way.