Featured Posts

Last week, people saw the 7% spike in the S&P 500 and called it a relief rally. Markets breathed. Volatility cooled off for a moment. But what actually happened wasn’t just a response to Trump’s sudden 90-day tariff pause. It was a pressure release after days

Let’s talk markets. Specifically, let’s talk about what just went down (literally) in the Nasdaq this week. If you’ve been paying attention—or maybe even if you haven’t—it’s gotten pretty ugly pretty fast. I even tweeted something about it: Markets take the stairs up

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

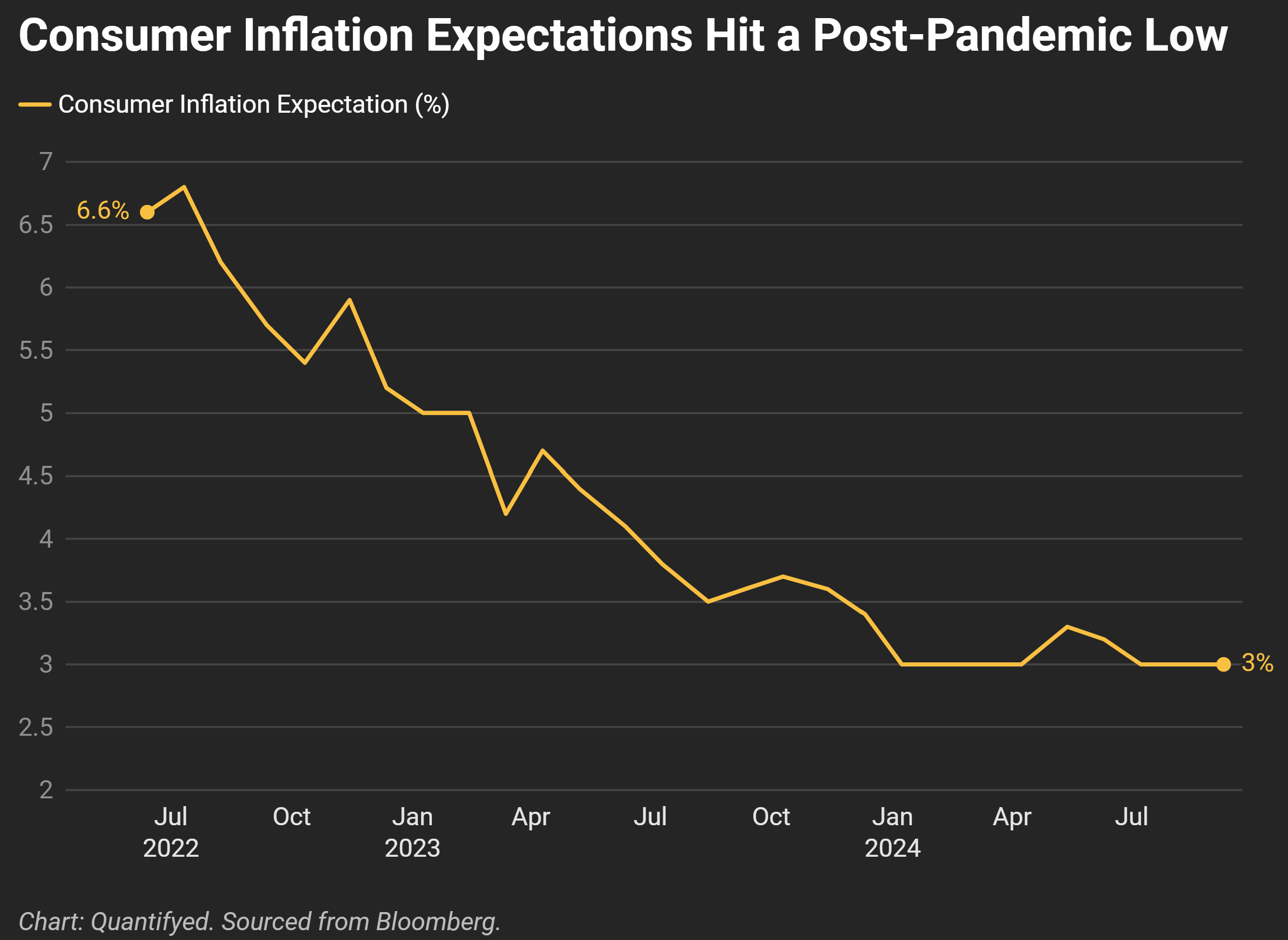

Consumers are increasingly optimistic about inflation, with expectations reaching a post-pandemic low of 3% in October 2024, according to recent data sourced from Bloomberg. This marks a significant drop from the peak of 6.6% in mid-2022, signaling a positive shift in inflation expectations as price pressures continue to ease.

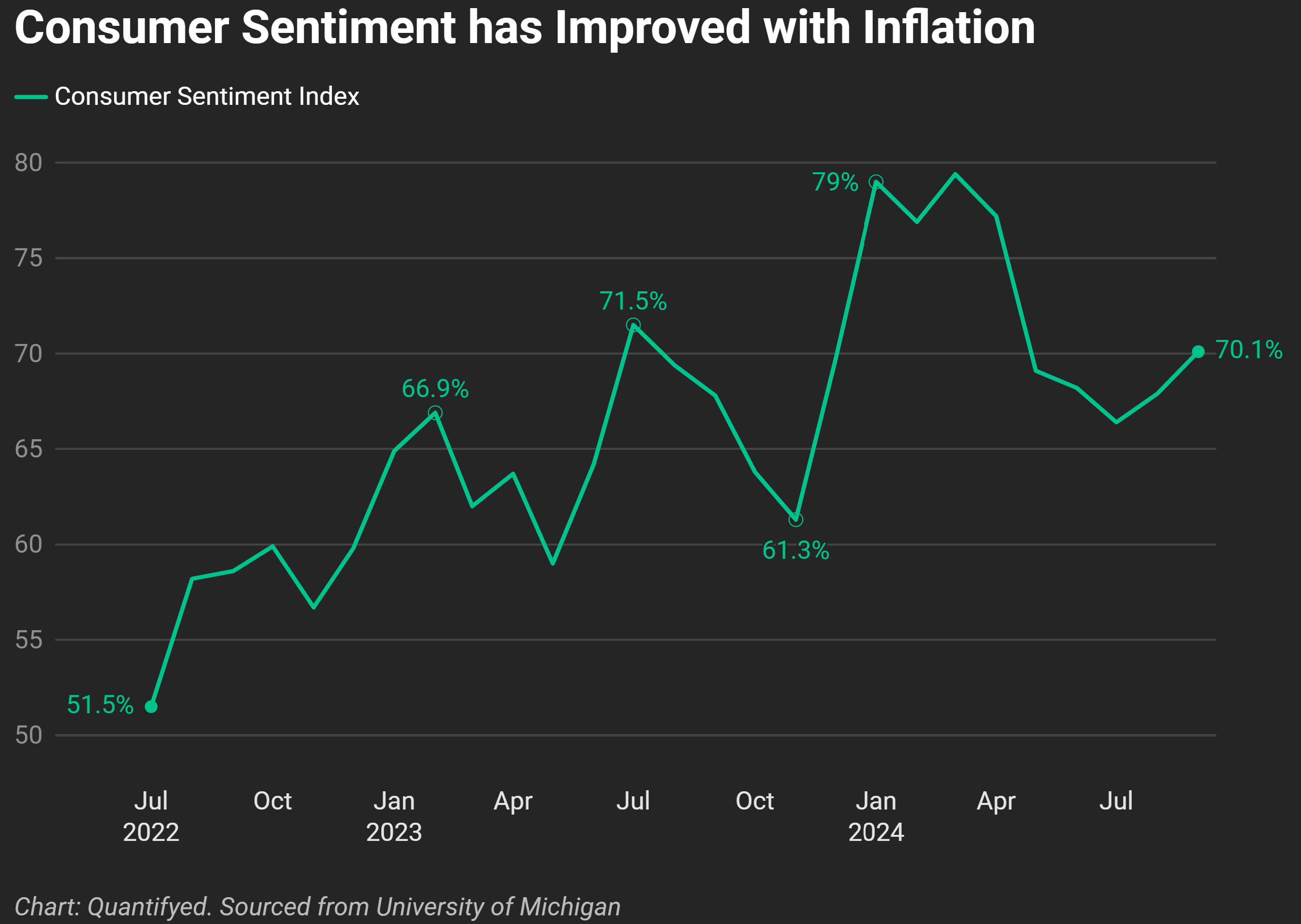

However, while inflation concerns have subsided, many Americans still express frustration over high prices, indicating a cautious outlook on personal finances and business conditions. The University of Michigan’s consumer sentiment index, highlighted in the second graph, shows that although sentiment has generally improved in line with inflation, there has been increased volatility in recent months.

In mid-2023, consumer sentiment peaked at 79%, fueled by hopes that inflationary pressures were easing. But as the campaign trail has heated up, and with the 2024 election looming, this optimism has faltered. The latest reading stands at 70.1%, reflecting growing uncertainty around the broader economic landscape. Many consumers remain skeptical about current conditions, despite lower inflation expectations, as concerns about personal finances and long-term stability persist.