Featured Posts

Last week, people saw the 7% spike in the S&P 500 and called it a relief rally. Markets breathed. Volatility cooled off for a moment. But what actually happened wasn’t just a response to Trump’s sudden 90-day tariff pause. It was a pressure release after days

Let’s talk markets. Specifically, let’s talk about what just went down (literally) in the Nasdaq this week. If you’ve been paying attention—or maybe even if you haven’t—it’s gotten pretty ugly pretty fast. I even tweeted something about it: Markets take the stairs up

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

As AI's energy needs skyrocket, tech giants are turning to nuclear power for help. Learn how this is the ultimate solution for fueling AI and why investors should pay close attention

Imagine this: you're deep into a conversation with ChatGPT about starting a business, and suddenly, just when you were about to create a groundbreaking idea, the power goes out.

The culprit? AI's insatiable energy appetite. As artificial intelligence (AI) continues to devour electricity, tech giants are on the hunt for power sources that can keep up.

Enter nuclear power—our unlikely savior poised to be the next big investment for AI. Let’s dive into why nuclear power is the ultimate power-up AI needs to keep running smoothly.

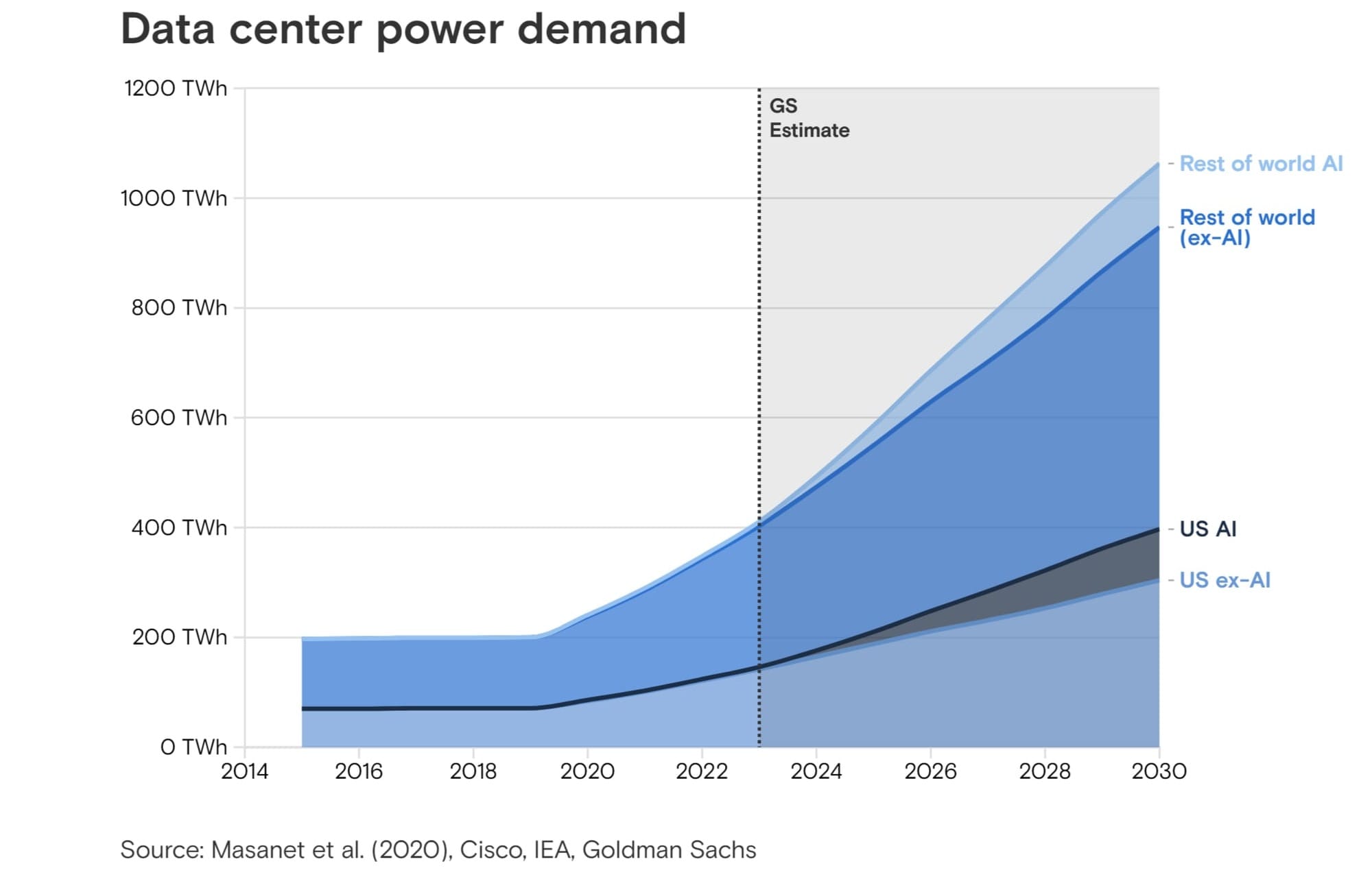

Rising Energy Demands of AI: The energy consumption required to support AI is skyrocketing. The computational power needed for AI applications is doubling every 100 days (WEF).

By 2030, data centers dedicated to AI could account for between 4.6% and 9.1% of the total U.S. electricity demand, up from the current 4%.

To put it in perspective, AI's annual energy consumption could rival that of the entire Netherlands by 2027 (Data Centre Review).

This enormous rise in energy demand highlights our need for stable and efficient power sources. Unlike hydro, wind, and solar that rely on unpredictable weather conditions, nuclear power is continuous and reliable.

So why should AI investors consider nuclear power?

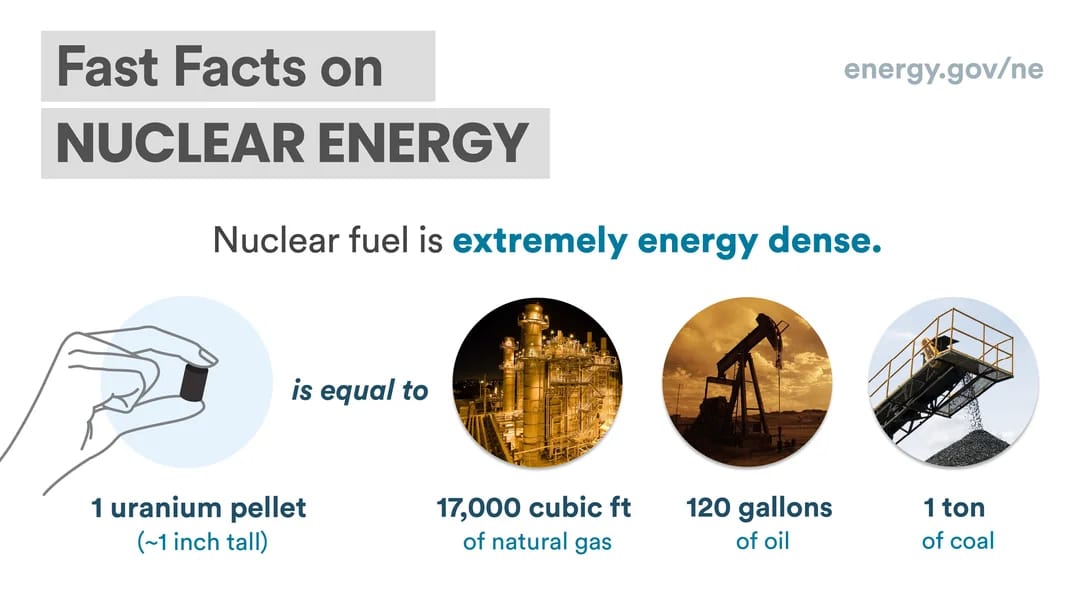

Stability and Reliability: Nuclear power plants deliver a constant, uninterrupted power supply, ensuring AI runs smoothly without a hiccup.

Carbon-Free Energy: In a world where tech companies comply with environmental social governance (ESG), nuclear power is a carbon-free energy source.

Cost-Effective Solutions: Direct power deals, where companies receive electricity directly from nuclear plants, lowers costs and speeds up our construction of data centers.

Several big-name investments highlight the growing interest in nuclear power among tech giants:

Amazon Web Services (AWS): AWS has made a strategic move by purchasing a $650 million nuclear-powered data center in Pennsylvania. This facility, capable of receiving up to 960 megawatts of electricity, demonstrates Amazon's commitment to securing reliable power for its AI operations (Popular Science).

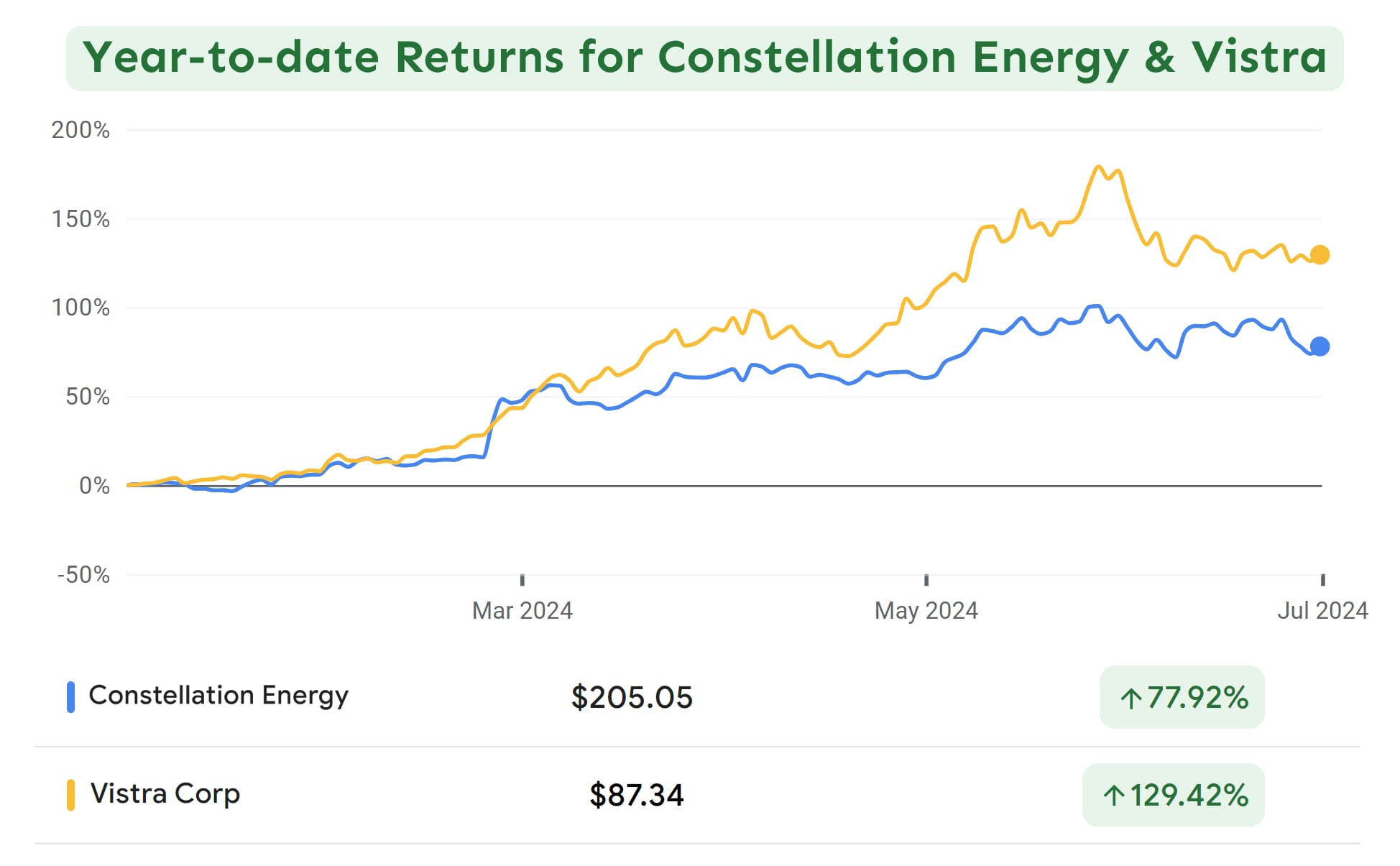

Constellation Energy: Known for its 14 nuclear plants that produce over 20% of U.S. nuclear power, Constellation Energy has seen its shares soar by 70% due to increasing demand from tech companies.

Vistra: Vistra, another nuclear company, had with its shares double in value from these direct power deals.

With tech giants like Amazon and Constellation Energy leading the charge, nuclear power is becoming a critical investment for AI.

Its stability, reliability, and carbon-free nature make it an ideal energy source for powering this new wave of demand. Nuclear power has advantages that can’t be ignored.