Featured Posts

Last week, people saw the 7% spike in the S&P 500 and called it a relief rally. Markets breathed. Volatility cooled off for a moment. But what actually happened wasn’t just a response to Trump’s sudden 90-day tariff pause. It was a pressure release after days

Let’s talk markets. Specifically, let’s talk about what just went down (literally) in the Nasdaq this week. If you’ve been paying attention—or maybe even if you haven’t—it’s gotten pretty ugly pretty fast. I even tweeted something about it: Markets take the stairs up

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

So, OPEC decided to throw us a curveball. The cartel trimmed its oil-demand growth forecast, blaming China for lower expected demand. But while OPEC thinks demand for oil would fall, oil prices seem to be doing the exact opposite. Confused? Yeah, me too. Let’s dive into the numbers.

OPEC’s Forecast Revision

Let’s start with the facts. OPEC has now revised its forecast, expecting oil demand to grow by 2.11 million barrels per day (bpd) this year. That’s a step down from their previous estimate of 2.25 million bpd.

We’re talking about a total demand that’s still expected to hit 104.3 million bpd on average. To put that in perspective, pre-pandemic demand was around 1.4 million bpd—so we’re still way above that.

Why the revision? Well, OPEC’s got its eyes on China. Slower-than-expected growth in the world’s biggest crude importer made OPEC less optimistic.

Despite the downgrade, demand is far from collapsing. In fact, it’s still at very healthy levels. Strong air travel, road mobility, and robust industrial activity is sustaining demand.

Looking ahead, OPEC also cut a little off next year’s growth forecast, trimming it down to 1.78 million bpd from 1.85 million bpd. The reason? More of the same: concerns about China’s economic performance and how it might spill over into 2024. It’s not a doom-and-gloom scenario, but OPEC’s definitely keeping an eye on the exit.

The Confusing Part: Oil Up Despite Demand Down

Here’s where things start to get confusing. You’d think that with OPEC cutting its demand forecast, oil prices would take a hit. But nope, the market had other plans.

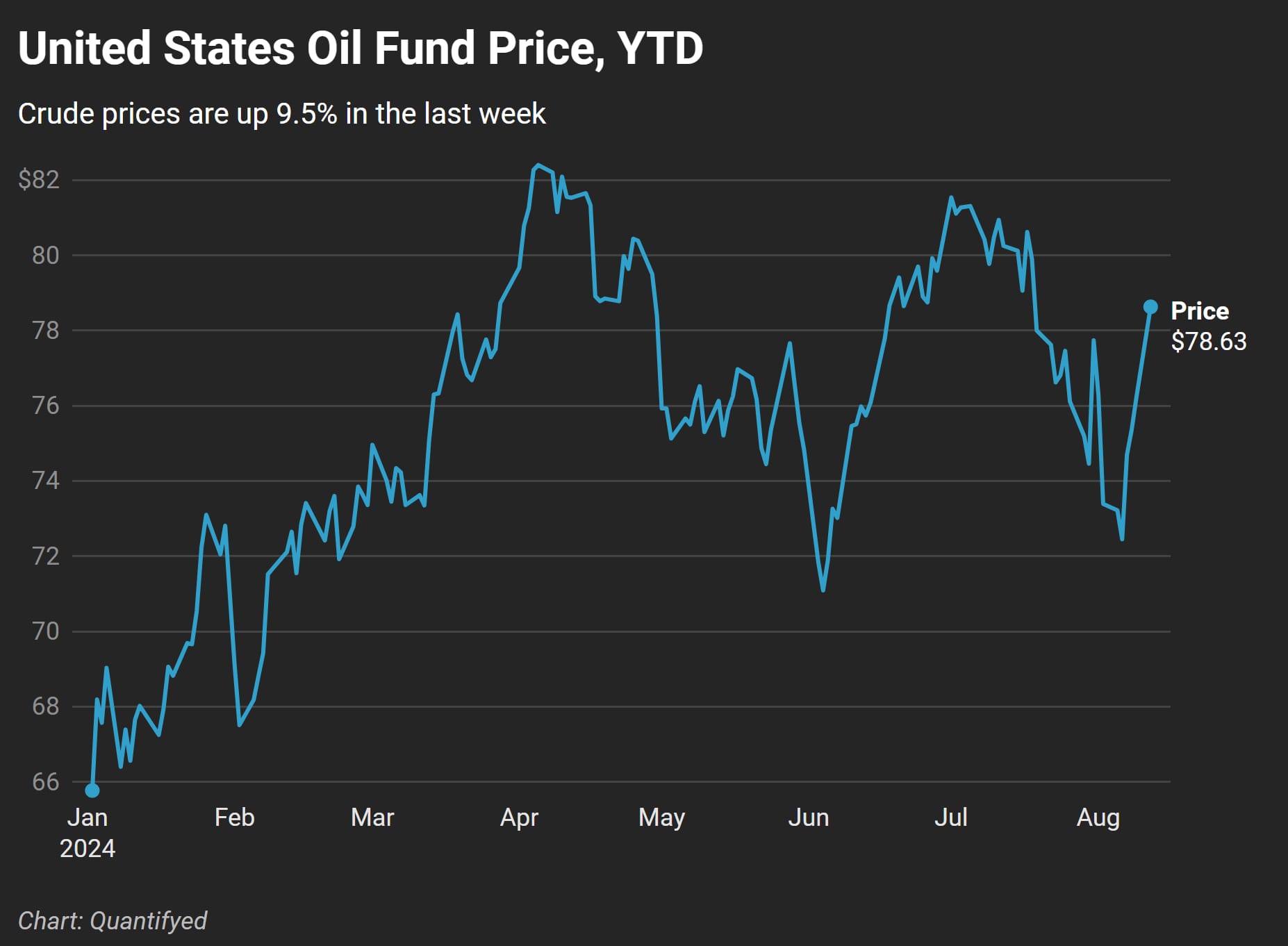

The United States Oil Fund, the gold standard for tracking crude prices, is up 9.5% in the past week. Why? Fears of a full-scale war in the Middle East, a brewing showdown in Ukraine, and Libya shutting down its largest oil field have traders worried.

OPEC might be more cautious, but the oil market’s got a mind of its own. Prices are surging not because demand is soaring, but because the fears of war are worrying traders.