Featured Posts

Last week, people saw the 7% spike in the S&P 500 and called it a relief rally. Markets breathed. Volatility cooled off for a moment. But what actually happened wasn’t just a response to Trump’s sudden 90-day tariff pause. It was a pressure release after days

Let’s talk markets. Specifically, let’s talk about what just went down (literally) in the Nasdaq this week. If you’ve been paying attention—or maybe even if you haven’t—it’s gotten pretty ugly pretty fast. I even tweeted something about it: Markets take the stairs up

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

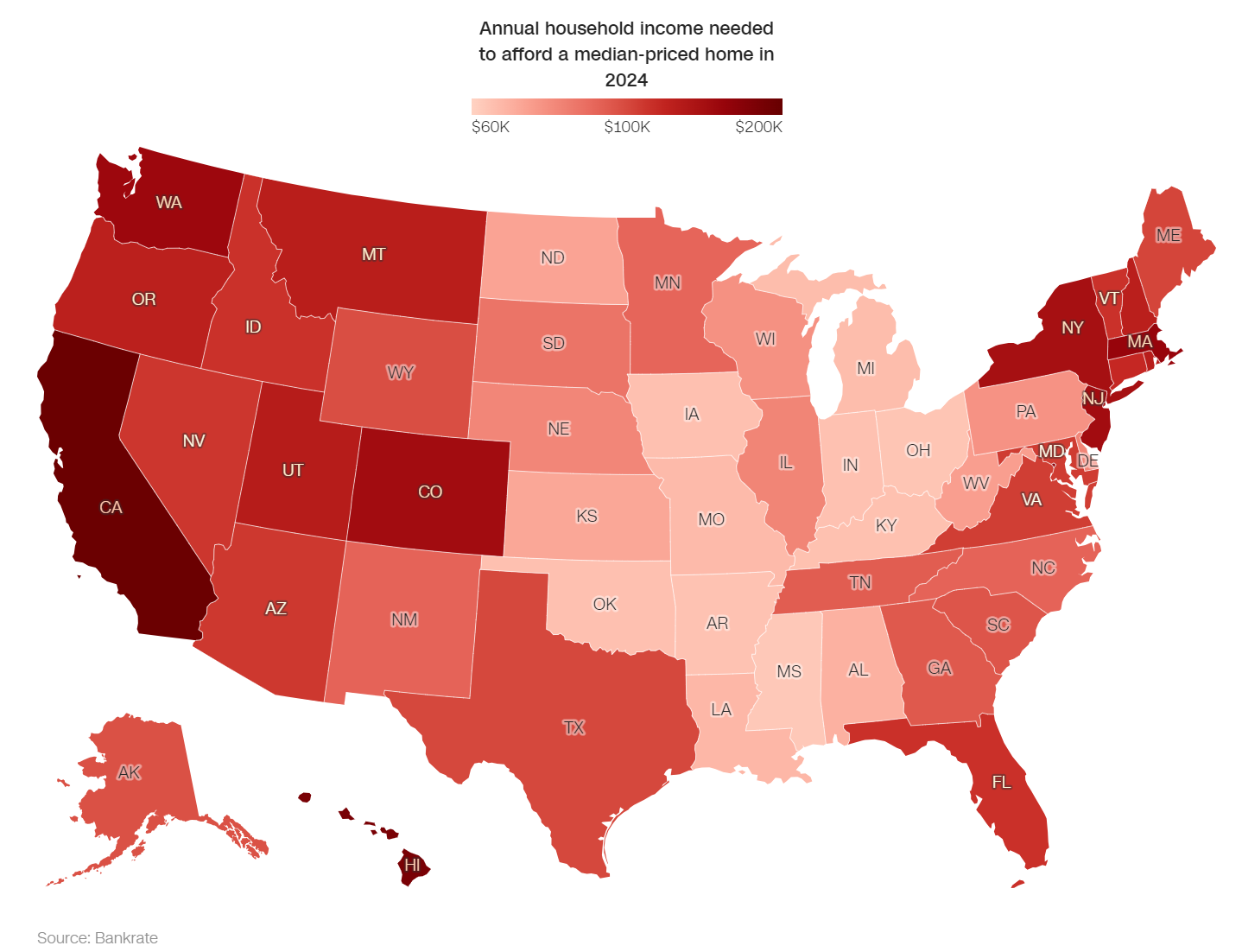

Owning a home has always been an American dream, but data tells us a different story for the future of homebuyers in our economy.

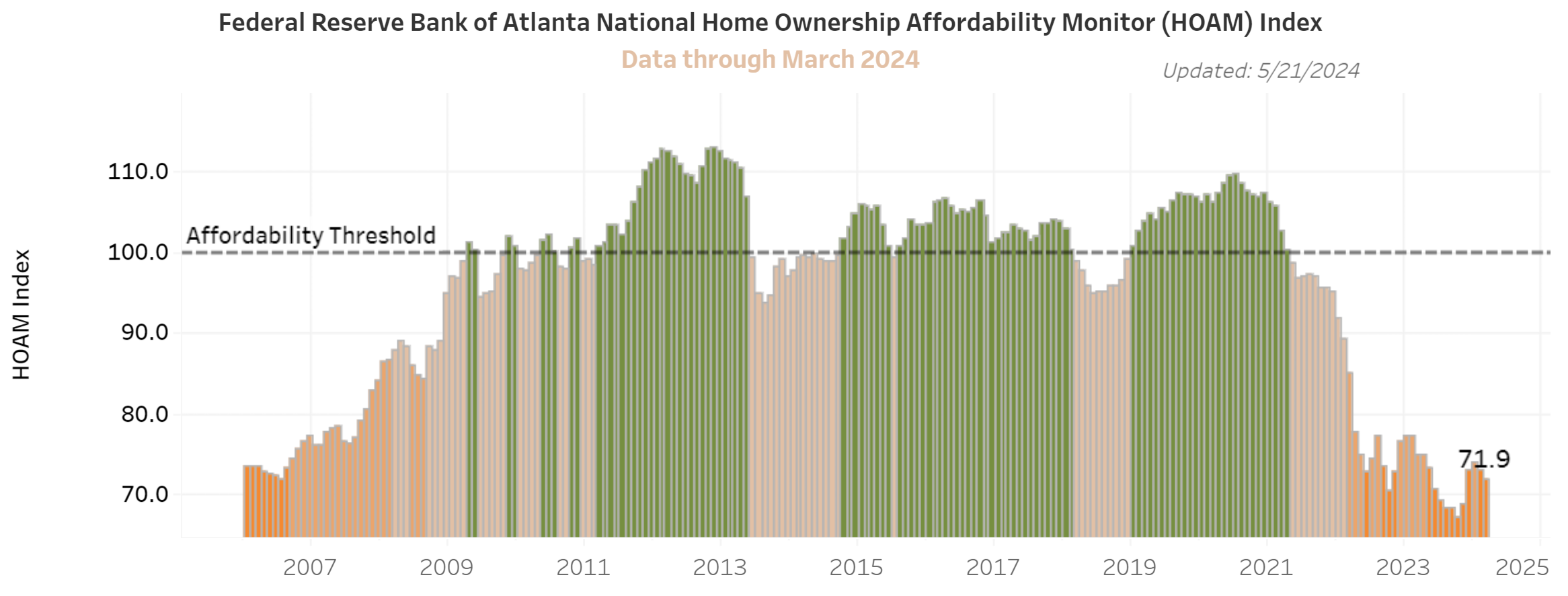

According to the Federal Reserve Bank of Atlanta, the Home Ownership Affordability Monitor (HOAM) index reveals some news: home affordability is in the dumps again. The index measures how well a median-income household can cover the annual costs of owning a median-priced home, and the results aren't pretty.

If you're dreaming of home ownership, brace yourself. Higher home prices and increased interest rates mean have impacted many people’s intentions of owning a home.

There are several factors impacting our affordability:

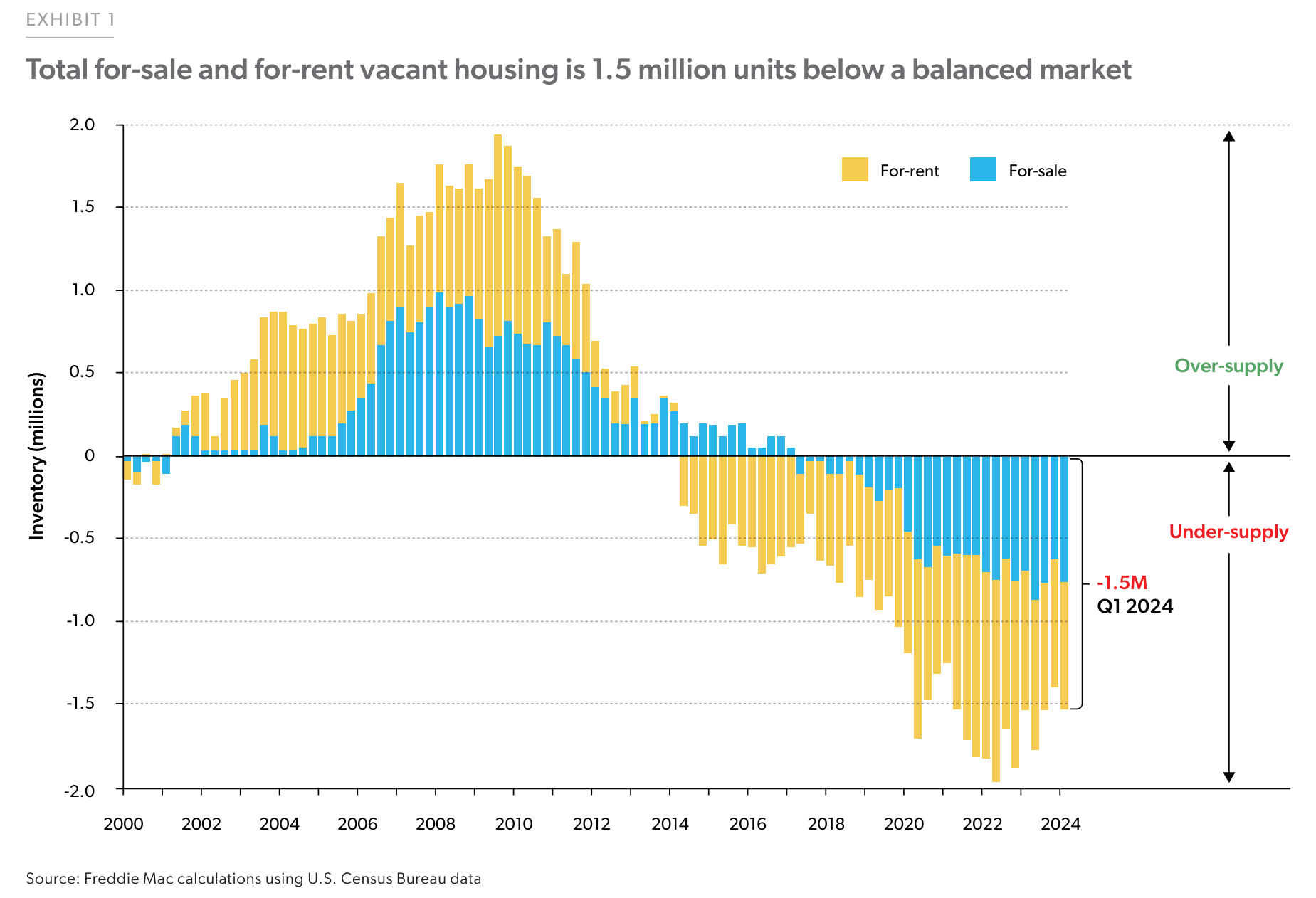

Housing Starts: Housing starts (AKA new homes being built) have, for a long time, not been able to meet demand. From Business Insider, "This year, the construction industry is short about 500,000 workers".

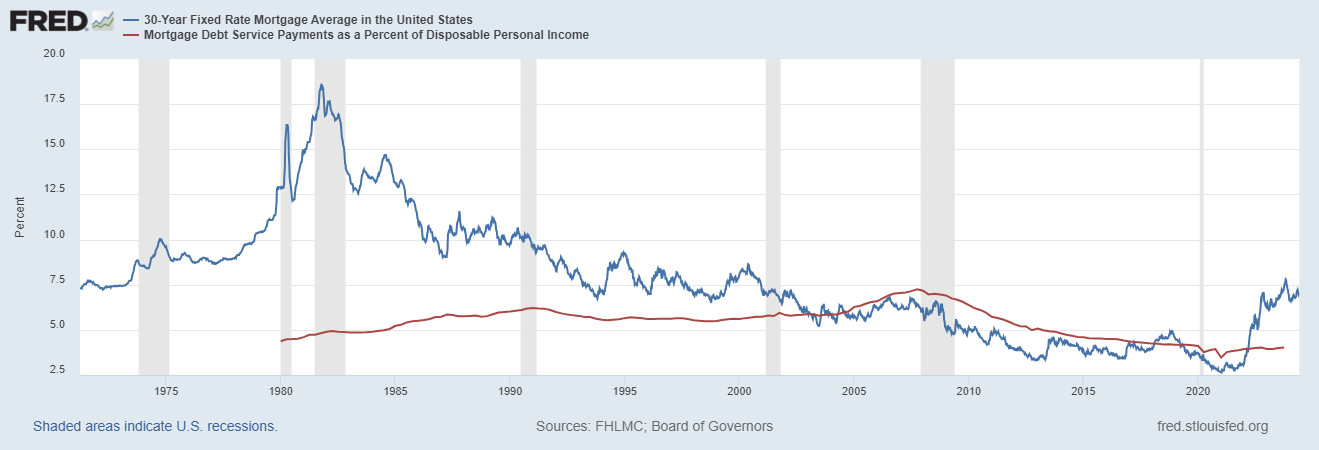

Mortgage Rates: The federal reserves' rate hikes that ended in July of last year have increased borrowing costs for consumers. Mortgage rates have skyrocketed in part because of their action.

Wages: Slow wage growth coupled with sticky inflation has been a root cause in our housing affordability. Since 2020, nominal wages in the U.S. have risen 13.6% vs 30% for median home prices.

The bottom line?

It's not all doom and gloom! It's important to understand how our economy is navigating this trend in real estate. By staying informed on these insights, you can make smarter decisions, approaching the housing market more wisely.