Featured Posts

Last week, people saw the 7% spike in the S&P 500 and called it a relief rally. Markets breathed. Volatility cooled off for a moment. But what actually happened wasn’t just a response to Trump’s sudden 90-day tariff pause. It was a pressure release after days

Let’s talk markets. Specifically, let’s talk about what just went down (literally) in the Nasdaq this week. If you’ve been paying attention—or maybe even if you haven’t—it’s gotten pretty ugly pretty fast. I even tweeted something about it: Markets take the stairs up

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

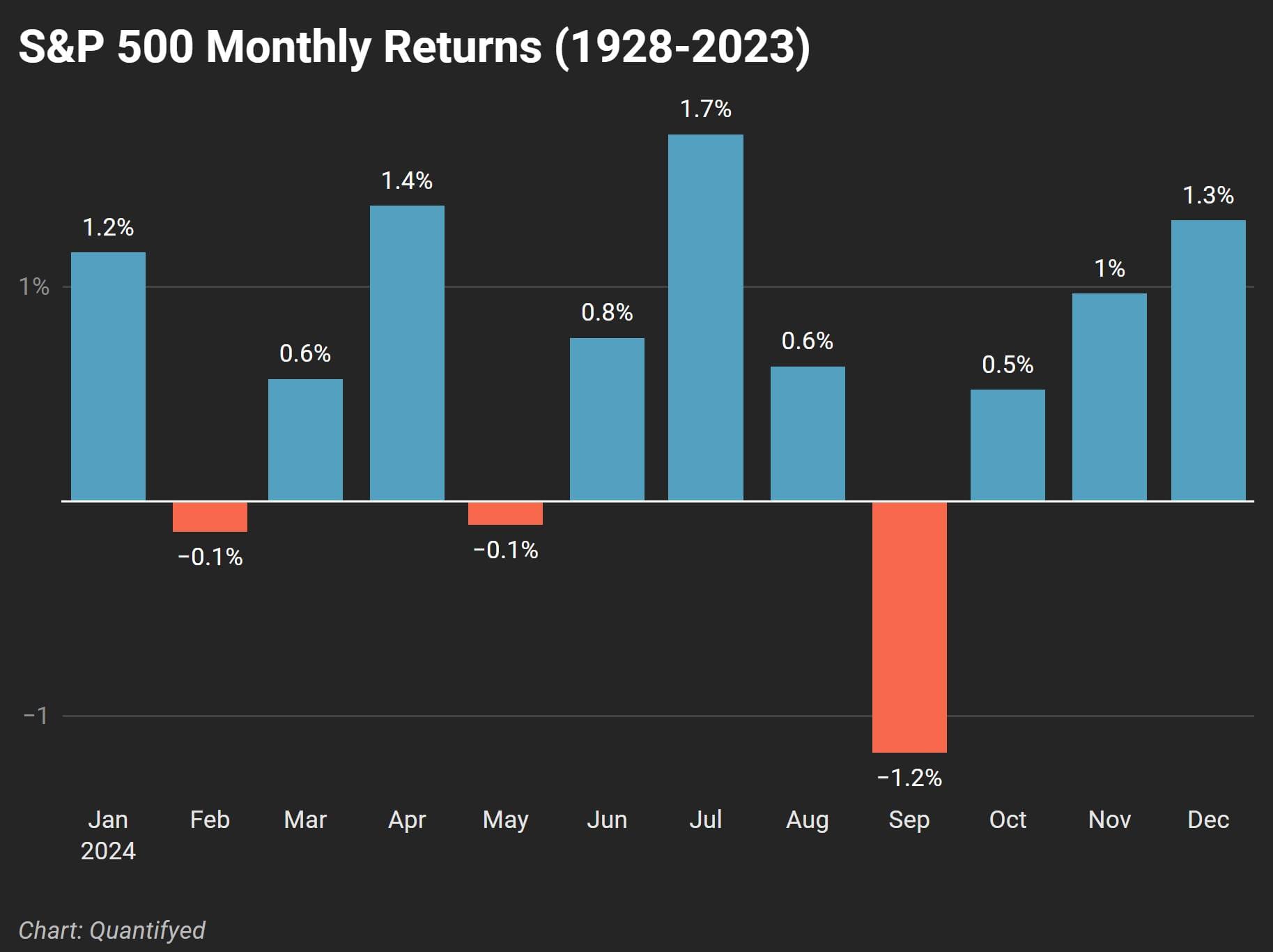

September has historically been the worst month for the stock market. Why?

Historically, September has been a tough month for the stock market. Data from Dow Jones reveals that the major U.S. indexes, including the S&P 500, typically underperform during this month. This trend has been consistent for decades, with September witnessing some of the most significant market downturns, like the post-9/11 slump and the 2008 financial crisis.

Why September Stinks: One of the main reasons September is difficult for the markets is that traders and investors return from their summer vacations and reassess their portfolios. Additionally, as companies begin preparing their year-end profit and loss statements, some choose to sell better-performing assets to take profits.

Why September Could Be Rough: This September might be especially volatile. Despite a strong August, red flags are on the horizon. Nvidia’s recent earnings report, while strong, included weaker sales guidance, leading analysts to question whether the AI rally is a bubble. Furthermore, the upcoming Federal Reserve meeting on September 18th and the August jobs report could unsettle the market if they disappoint investors.

Beyond domestic factors, global risks could impact the market this month. The U.S. presidential election and tensions in the Middle East could lead to increased market volatility. Markets don’t like uncertainty, and these factors only add fuel to the fire.

How do you think the markets will behave in September? As we head into a possibly volatile month, one key factor on every investor's mind is the Federal Reserve's rate decisions. Curious about how the Fed's upcoming rate cut cycle might impact companies? Click here