Featured Posts

Last week, people saw the 7% spike in the S&P 500 and called it a relief rally. Markets breathed. Volatility cooled off for a moment. But what actually happened wasn’t just a response to Trump’s sudden 90-day tariff pause. It was a pressure release after days

Let’s talk markets. Specifically, let’s talk about what just went down (literally) in the Nasdaq this week. If you’ve been paying attention—or maybe even if you haven’t—it’s gotten pretty ugly pretty fast. I even tweeted something about it: Markets take the stairs up

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

So, here’s something no one seems to be making a big deal about: tariffs are rising fast, and they’re dragging the US economy down.

You won’t hear much about it in the headlines, but the effects could start to pile up. Higher prices, weaker growth, and more uncertainty for businesses.

The average US tariff rate is set to jump by 10% this year. That’s double previous estimates and five times higher than the increases during the first Trump administration, per Goldman Sachs.

Tariffs are basically just taxes on imports, but here’s the thing: those costs don’t stay with foreign companies. They get passed straight to American consumers and businesses.

Why Tariffs Are a Bigger Problem Than You Think

Some people argue that tariffs are just a negotiating tool or a short-term hit for long-term gain. But in the meantime, they’re doing real damage in two key ways:

First, every time tariffs increase, so do consumer prices. For every 1 percentage point increase in the average US tariff rate, real income drops by 0.1%. That may not sound like much, but across millions of people, it’s significant.

Think about it. Many everyday items—electronics, appliances, even cars—depend on imported parts. When tariffs go up, businesses don’t just eat that cost. They pass it on to consumers. And when everything costs more, people cut back on spending, which slows the economy down even further.

Businesses Are Stalling Decisions

If there’s one thing businesses hate, it’s uncertainty. And right now, nobody knows where trade policy is heading next.

We saw this exact scenario play out during the 2018-2019 trade war. Companies froze investments, delayed expansions, and played it safe instead of taking risks.

If businesses aren’t expanding, they’re not hiring. If they’re not hiring, consumer spending weakens. And if spending weakens? That brings us to the final piece of the puzzle.

Inflation Expectations Creeping Up

For a while, it seemed like inflation was cooling off. But tariffs are throwing a wrench in that. When import taxes rise, costs go up, and that fuels inflation all over again.

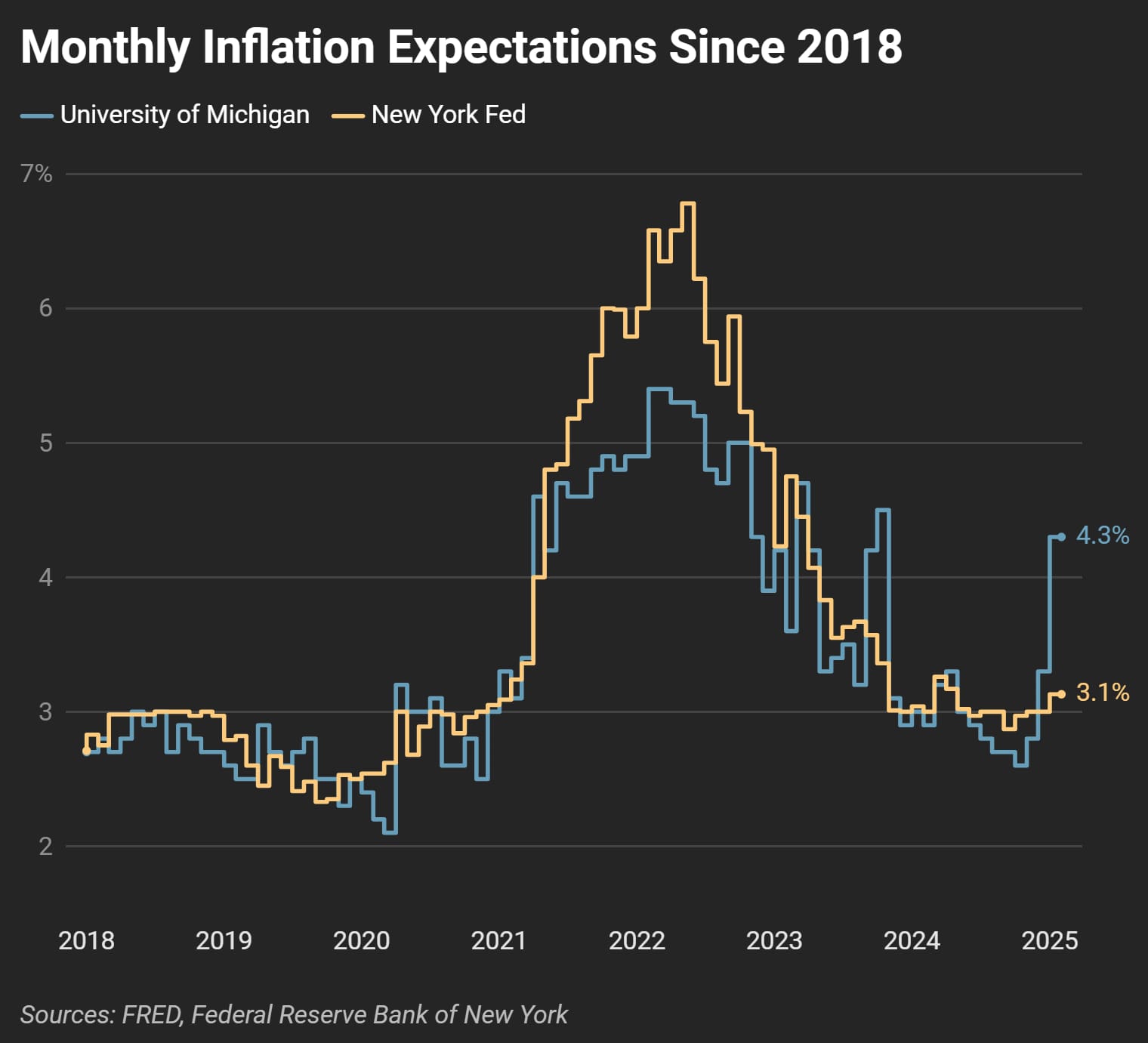

Don’t just take my word for it. Look at the data:

That sharp jump on the right? That’s recent inflation expectations shooting up.

And that’s coming from two of the most closely watched surveys—the University of Michigan and the New York Fed.

If inflation jumps, the Federal Reserve may be forced to hold off on interest rate cuts, which would slow growth even more.

Where Does This Leave Us?

The economy is still growing, but not as fast as it should be. Trade policies like this tend to stick around, which means this drag on growth might not go away anytime soon.

At some point, we might start noticing. Prices will feel a little higher. Business expansion will feel a little slower. The market might feel a little shakier.

Where do you think our trade war will end up?