Featured Posts

Last week, people saw the 7% spike in the S&P 500 and called it a relief rally. Markets breathed. Volatility cooled off for a moment. But what actually happened wasn’t just a response to Trump’s sudden 90-day tariff pause. It was a pressure release after days

Let’s talk markets. Specifically, let’s talk about what just went down (literally) in the Nasdaq this week. If you’ve been paying attention—or maybe even if you haven’t—it’s gotten pretty ugly pretty fast. I even tweeted something about it: Markets take the stairs up

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

The U.S. stock market keeps hitting new highs, but is this rally as solid as it looks? With earnings season kicking off, investors are waiting to see whether companies can keep delivering, or if we’re in for a reality check.

Why the Stock Market is Still Climbing

The S&P 500 Index is up 30.2% over the past three years, bouncing back from a rough drop of -20.3% in October 2022. The market has managed to power through all kinds of challenges—geopolitics, inflation, and more.

The Job Market is Crushing It. September’s jobs report blew everyone’s expectations out of the water, adding 254,000 jobs—72% higher than expected.

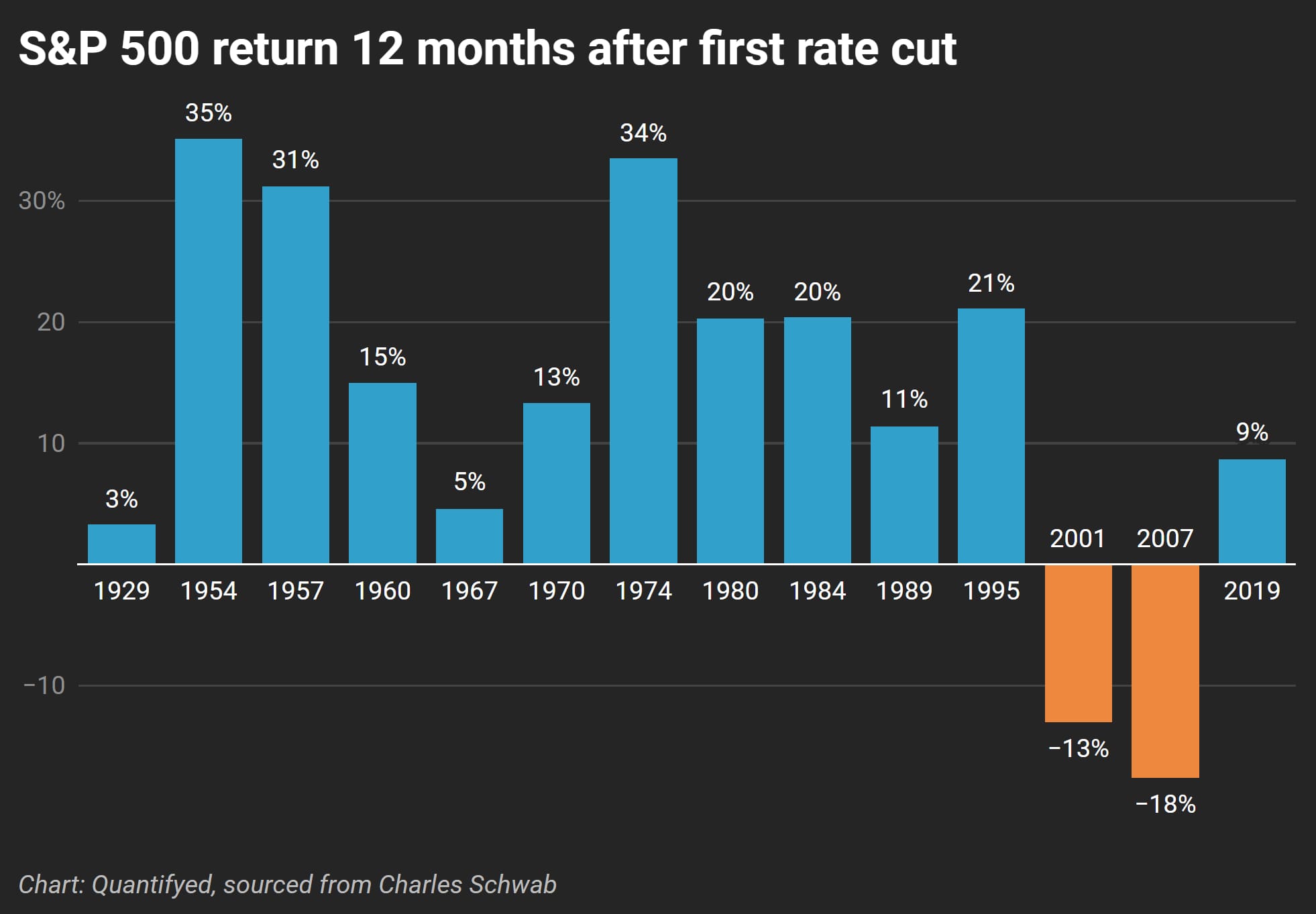

The Fed is Ready to Cut Rates. The market is betting on the Federal Reserve to start cutting interest rates soon. Historically, stock markets tend to do well after the Fed’s first rate cut, and investors are hoping this time will be no different. Just take a look at how the S&P 500 has performed after past rate cuts:

Despite the market’s strength, earnings season could throw a wrench in things. Analysts are expecting 4.3% growth for Q3, much lower from 10.3% in Q2. If companies start missing expectations, we could see the market take a hit.

What You Should Watch:

- S&P 500: The S&P 500 is up 30.2% over the last three years.

- Labor Market: The 254,000 jobs added in September and the drop in unemployment to 4.1% are big reasons the market is holding up.

- Earnings Season: With only 4.3% earnings growth expected in Q3, this season could determine if the rally continues or hits a wall.

- Energy Sector: Falling oil prices are hurting energy companies. If earnings in this sector come up short, it could drag down the market.

- Focus on Forward Guidance: Earnings reports matter, but what really counts is what companies say about the future.