Featured Posts

Last week, people saw the 7% spike in the S&P 500 and called it a relief rally. Markets breathed. Volatility cooled off for a moment. But what actually happened wasn’t just a response to Trump’s sudden 90-day tariff pause. It was a pressure release after days

Let’s talk markets. Specifically, let’s talk about what just went down (literally) in the Nasdaq this week. If you’ve been paying attention—or maybe even if you haven’t—it’s gotten pretty ugly pretty fast. I even tweeted something about it: Markets take the stairs up

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

Nasdaq 100 jumped 1.4% this morning, capping the strongest week since November 2024.

Markets are rallying, and the Fed President Chris Waller had this to say during a talk yesterday, per Bloomberg:

“The inflation data we got yesterday was very good”

Equities are surging, bond yields are cooling, and crypto is recovering.

Is this rally sustainable? Let’s break it down

Small Caps Steal the Show

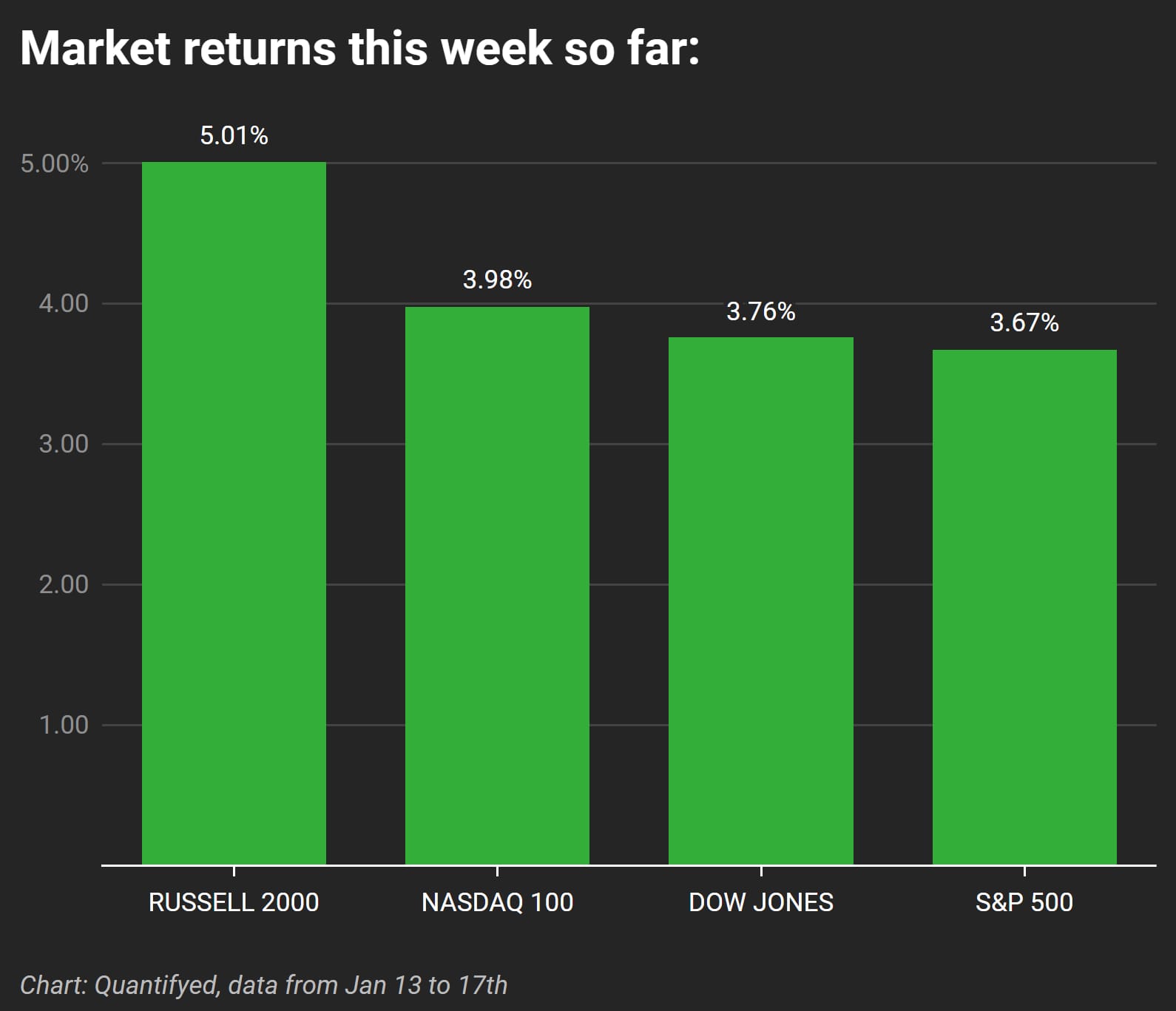

US stocks rallied across the board this week:

- Russell 2000: +5.01%

- Nasdaq 100: +3.98%

- S&P 500/Dow Jones: Both climbed around 3.7%

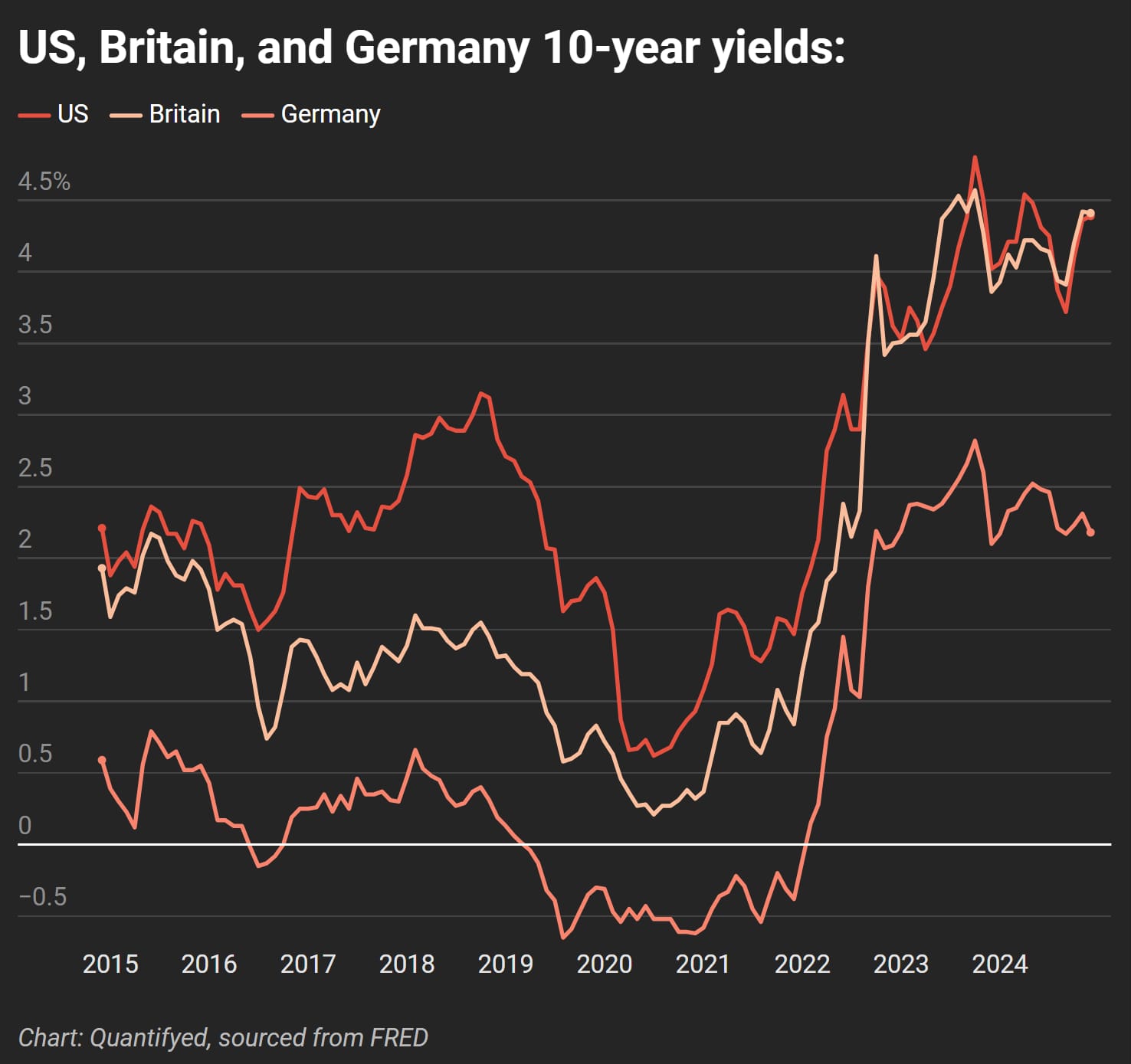

Bonds Finally Fall

Bond markets welcomed the Fed’s softer tone:

- US: Fell to 4.57%

- UK: Down to 4.62%

- Germany: Dropped to 2.51%

Dollar Won’t Budge

The US dollar still holding its ground as a leader:

- US Dollar Index: Rose slightly (+0.1%)

- British Pound: Fell 0.4% to $1.21

- Japanese Yen: Down 0.3%

Crypto Makes a Comeback

Bitcoin and Ethereum also jumped as confidence in risk assets returned:

- Bitcoin: +3.9%, breaking above $104K for the first time since December

- Ethereum: +3.3%, trading at $3,416

Commodities Stay Quiet

Commodities saw slower moves this week:

- WTI Crude Oil: Fell 0.2% to $78.54 per barrel

- Gold: Down 0.2% to $2,708 per ounce